The exit from the coal has been completed, the exit from the lignite is imminent. Nevertheless, mining in Germany has a future, because demand for other raw materials is increasing - for example, for potash salts for fertilizers or lithium for electric cars.

With the closure of the last hard coal mine, Germany is by no means saying goodbye to mining, says the managing director of the Association of Raw Materials and Mining. Martin Wedig:

"The Germans associate with mining mostly the mining of hard coal and lignite. In Germany, however, a large number of raw materials are mined which we need permanently for our daily needs as well as for our industry. "

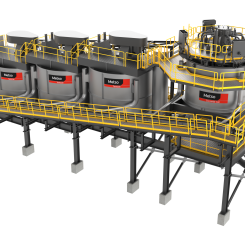

Such as large scale potash salts used as fertilizers in agriculture and needed for the production of various products in the chemical industry. In addition, quartz and quartz sands, refractory clays, graphite, magnesium, feldspar and fluorspar and kaolin are extracted:

Many jobs in the industry remain

"Even after the expiry of coal mining, there will still be a significant number of jobs in German mining. We're talking about more than 50,000 direct employees in German mining here, who are spread across the different mining sectors. "

Nearly 10,000 jobs are still there, also after the end of the hard coal underground breaking:

"Minerals are also mined underground in other commodity sectors. This includes, in particular, the potash and salt mining. Not in the Teufenlagen, as we know from the coal, with Teufen, which we have reached there to the end with 1,500 meters. There we are certainly in Teufenlagen of more 600 to 800 meters.

Also underground, industrial minerals such as barite and fluorspar are mined. For example in Baden-Württemberg and Saxony:

Mining is still an important economic factor

"Again, we have underground employment with a future."

The number of German companies operating in the mining industry is more than 1,000, which reduce nearly 900 million tons of various raw materials:

"If you take the hard coal out of it, at least twelve billion euros in sales remain in the German mining industry, based on the sales contributors in the stone and earth sector, in the ceramic industry potash and salt, lignite, and oil and natural gas."

After all, the oil and gas industry, which is predominantly located in northern Germany, covers at least ten per cent of domestic demand.

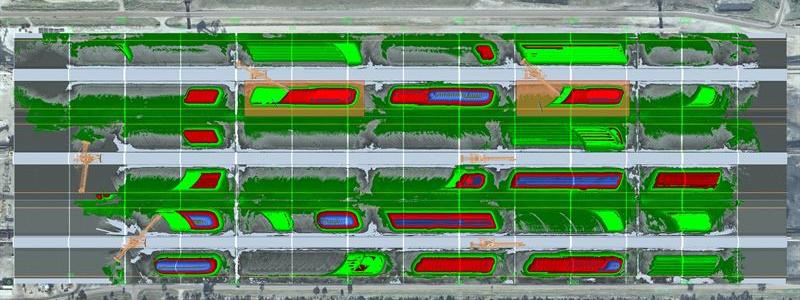

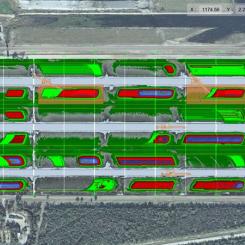

Martin Wedig estimates the macroeconomic production effect of the raw materials industry at around 20 billion euros per year. And since the average employment multiplier for direct mining employees is three, according to this calculation about 200,000 jobs in the Federal Republic depend on continuing mining. In addition, a whole series of new mines have been put into operation in recent years. For example, in the Saxon region, near the Czech border.

New mines - also for lithium

"There is broken down the river of the river. Currently, the annual production rate is around 100,000 tonnes. Sounds a bit little at first, but is quite much compared with world funding of just seven million tons."

In the coming year, another mine in Saxony will start producing in a tungsten mine:

"Wolfram, just a coveted finishing ore. In this respect, securing the supply of raw materials in Germany is worthwhile, as otherwise, supply problems would be likely in the long term due to high international prices and existing dependencies. "

In the context of advancing electromobility, lithium is also gaining in value with regard to high-performance batteries, which will be mined in the Zinnwald mine next year.

The chapter of German mining is far from finished.