Norwegian energy major Equinor has agreed to sell its entire onshore portfolio in Argentina’s Vaca Muerta shale region in a deal worth about $1.1 billion. The buyer, Vista Energy, will acquire the company’s minority stakes in two producing assets where Equinor has been a non-operator.

The transaction includes Equinor’s 30 per cent interest in Bandurria Sur and 50 per cent in Bajo del Toro. The company’s offshore exploration licences in Argentina are not part of the deal and will remain in its portfolio.

At closing, Equinor will receive $550 million in cash and shares in Vista Energy. Additional contingent payments linked to production levels and oil prices over five years are also included. The agreement has an effective date of July 1, 2025.

– We are realising value from two high-quality assets that we have actively developed, while continuing to sharpen our international portfolio, said Philippe Mathieu, head of Exploration & Production International, in a company statement.

Focus on core markets

Equinor says the transaction strengthens its financial flexibility at a time when investment priorities are under review across its global operations.

– The transaction strengthens Equinor’s financial flexibility as we evaluate opportunities across our core international markets, where we see significant growth towards 2030. At the same time, we retain optionality through our offshore positions in Argentina, Mathieu said.

The company points to Brazil, the United States and the United Kingdom as the key markets expected to drive production and cash flow in the coming years.

Equinor entered Argentina in 2017 through a joint exploration agreement with state-controlled YPF in the Bajo del Toro area. The onshore portfolio was expanded in 2020 with the acquisition of a stake in Bandurria Sur.

Production and next steps

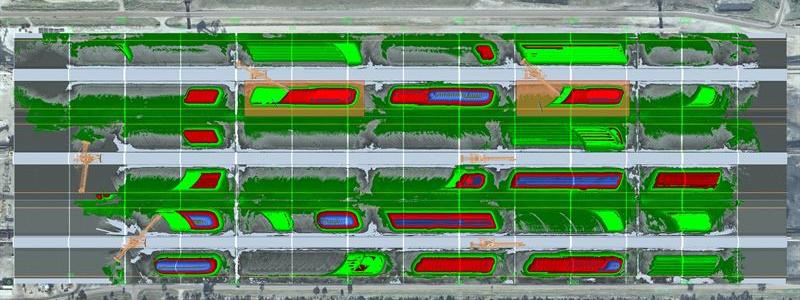

In the third quarter of 2025, Equinor’s net share of production at Bandurria Sur averaged 24,400 barrels of oil equivalent per day. Bajo del Toro, still in an early development phase, contributed about 2,100 barrels of oil equivalent per day net to Equinor.

Alongside its onshore presence, Equinor has built an offshore exploration portfolio in Argentina since 2019. This includes eight licences in the Northern Argentina basin as well as the Austral and Malvinas basins. Subsurface evaluation work is ongoing to determine the most commercially viable path forward. There are currently no firm drilling commitments tied to the licences.

– This is a value-driven decision that strengthens the resilience of our international portfolio and sharpens our focus in Argentina, said Chris Golden, responsible for the United States and Argentina within Exploration & Production International.

Vaca Muerta context

Vaca Muerta is considered one of the world’s largest shale formations for oil and gas and has attracted substantial international investment over the past decade. Development, however, remains capital-intensive and is shaped by infrastructure constraints and recurring political and economic uncertainty in Argentina.

For international energy companies, portfolio adjustments and risk reduction have become increasingly important amid volatile energy markets and tighter capital discipline. Equinor’s decision reflects a broader trend of focusing investment on core regions with clearer returns and regulatory stability.

Source: Equinor press release.