Sabina Gold & Silver Corp announces that its shareholders voted overwhelmingly in favour of the proposed acquisition by B2Gold Corp.

According to the agreement, Canada-based B2Gold will acquire all issued and outstanding SBB common shares via a plan of arrangement. In exchange, B2Gold will issue 0.3867 of a common share for each Sabina common share held, at C$1.87 per Sabina Share on a fully diluted basis.

“I would like to express my sincere appreciation to Sabina’s stakeholders for their support in advancing this incredible project,” said Bruce McLeod, President & CEO. “Without their backing, and the significant talent of our Sabina employees over the years, the Back River Gold District would not be the world class asset that it is today. B2Gold’s involvement as an intermediate producer with greater financial capacity provides additional de-risking of the project and leaves Sabina shareholders with a meaningful stake in the combined Company. As an all share-based transaction, the implied value of the offer is $2.20 per share or $1.2 billion (at yesterday’s close). Following the positive outcome of the shareholder vote today, we look forward to working closely with B2Gold to close this transaction on or about April 19, 2023.”

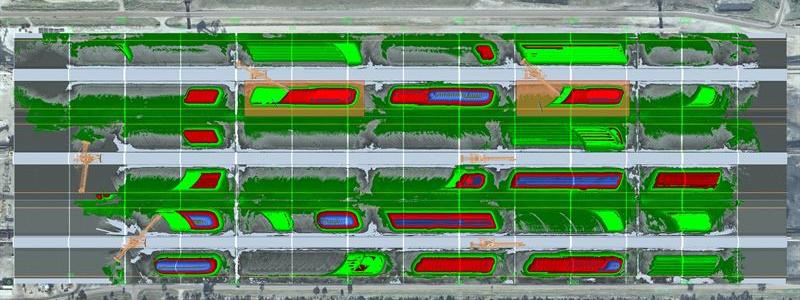

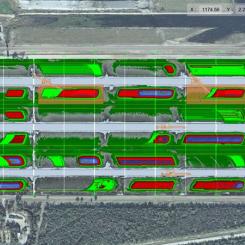

Sabina Gold & Silver Corp. is an emerging gold mining company that owns 100% of the district scale, advanced, high grade Back River Gold District in Nunavut, Canada.