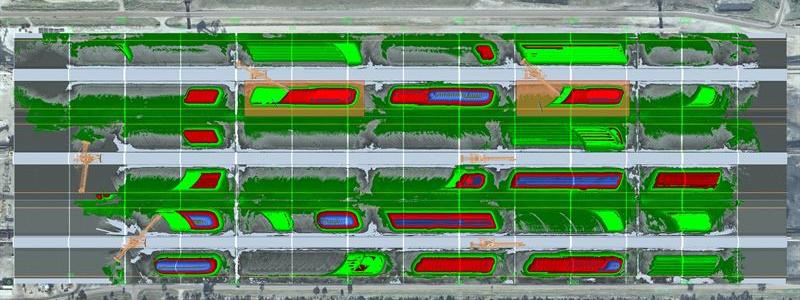

Tax administration has discovered companies in the steel trade that do not declare or pay VAT for their sales in Finland. The problems especially concern foreign sole proprietors who sell reinforcement steels and steel fittings to Finnish companies.

The buyer is required to investigate the reliability of his trading partners, points out the Tax Administration. The buyer can thus be held liable for the loss of value added tax.

In order to combat so caller grey economies, some EU countries, including Poland, Estonia and Latvia, have introduced a reverse tax liability for steel trade. In the case of reverse tax liability, the buyer is liable to pay VAT to the state.

The tax administration gives eleven tips to companies for revealing a dishonest actor. The clearest tip is to be vigilant. If the deal feels dishonest, it's probably that.