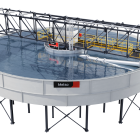

Lundin Mining has announced it closed its acquisition of a 100% stake in Mineração Maracá Indústria e Comércio S/A, the owner of the Chapada copper-gold mine located in Brazil. The total cash consider-ation Lundin paid at closing was US$800 million.

Lundin Mining says the mine’s previous owner, Yamana, retains a 2.0% net smelter return royalty on future gold production from the Suruca gold deposit. The company was also given a “contingent consideration of up to US$125 million over five years if certain gold price thresholds are met and contingent consideration of US$100 million on potential construction of a pyrite roaster,” according to the statement.

“The addition of Chapada further solidifies Lundin Mining’s position as a leading intermediate base metals producer. We look forward to estab-lishing an excellent reputation in Brazil as we work closely with our new employees and stakeholders. Leveraging our technical expertise, base metals focus and financial strength, we believe further opportunities ex-ist to create meaningful stakeholder value from this high-quality asset,” said Marie Inkster, the president and CEO of Lundin Mining.