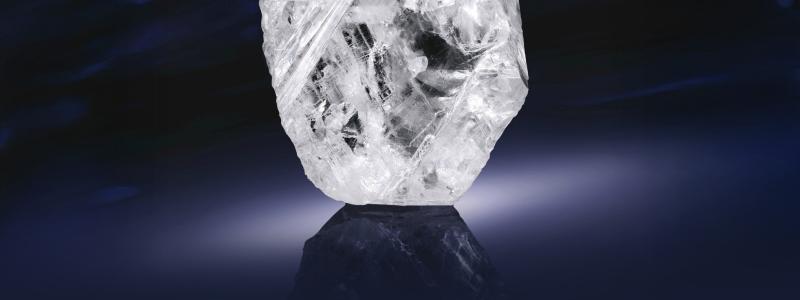

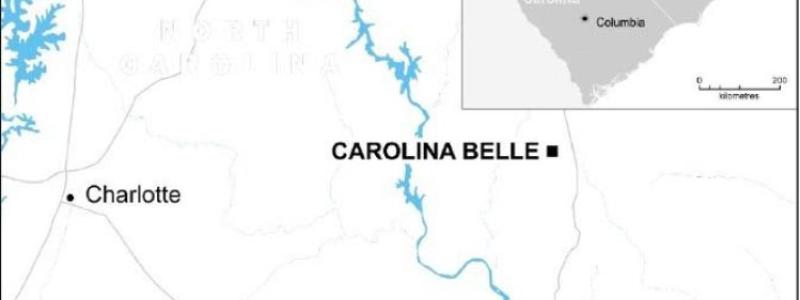

Piedmont Lithium Limited announces that it has entered into a binding agreement with Tesla, Inc. for the supply of spodumene concentrate from Piedmont’s North Carolina deposit to Tesla.

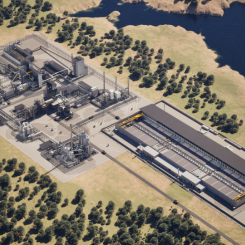

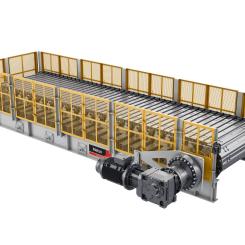

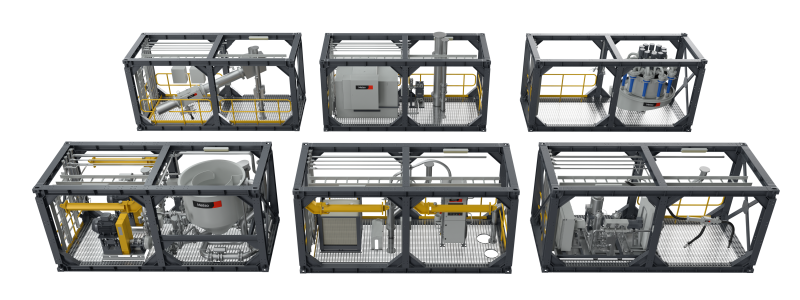

The Agreement is for an initial five-year term on a fixed-price binding purchase commitment from the delivery of first product, and may be extended by mutual agreement for a second five-year term. The Agreement covers a fixed commitment representing approximately one-third of Piedmont’s planned SC6 production of 160,000 tonnes per annum for the initial five-year term as well as an additional quantity to be delivered at Tesla’s option. The SC6 sales are expected to generate between 10-20% of Piedmont’s total revenues from its proposed integrated mine-to-hydroxide project for the initial five-year term. The Agreement is conditional upon Tesla and Piedmont agreeing to a start date for spodumene concentrate deliveries between July 2022 and July 2023 based on the development schedules of both parties.

Keith D. Phillips, President and Chief Executive Officer, commented: “We are excited to be working with Tesla, which represents the start of the first US domestic lithium supply chain and a disruption to the current value chain. The Agreement highlights the strategic importance of Piedmont’s unique American spodumene deposit and confirms the trend toward spodumene as the preferred feedstock for the lithium hydroxide required in high-nickel batteries.

“We will now accelerate our mine/concentrator development to support Tesla’s plans, work to further expand our mineral resources, and potentially increase our planned annual spodumene concentrate production capacity. We will simultaneously be advancing our plans to produce lithium hydroxide in North Carolina, using a combination of internally produced spodumene concentrate as well as material sourced from other producers around the world.”

Piedmont confirms that all material assumptions underpinning the results of its previously announced integrated scoping study (refer ASX announcement dated May 26, 2020) continue to apply and have not materially changed, including Benchmark Mineral Intelligence pricing and tonnes per annum assumptions.

To view the full ASX Announcement, click here.