The Austrian government has extended the mining licence for the Wolfsberg lithium project by two years, giving developers more time to secure financing and reach a final investment decision. The project is located in Carinthia in southern Austria and is being developed by Critical Metals.

The extension ensures that the licence remains valid despite earlier reports that it could expire. A final decision on whether to proceed with mining is expected no later than the end of 2026.

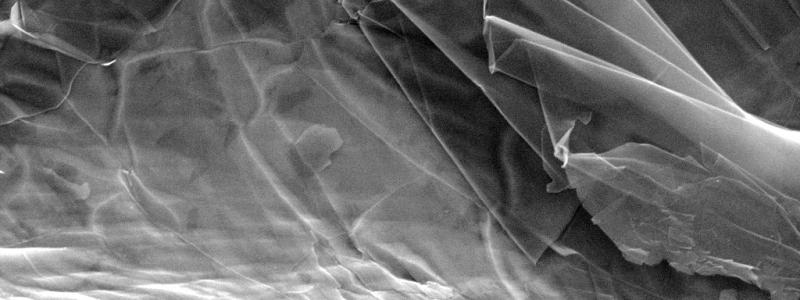

Wolfsberg lies about 270 kilometres south-west of Vienna and is described as a significant hard-rock lithium deposit with road and rail links to European markets. The additional time allows the company to assess market conditions and funding options before committing to construction.

Market recovery shapes outlook

The company says lithium markets have recovered in recent months after a period of falling prices. According to Critical Metals, prices for several key lithium compounds have risen sharply from lows seen at the start of 2025.

In China, battery-grade lithium carbonate has climbed to around 168,000–170,000 yuan per tonne, equivalent to roughly 23,000–24,000 US dollars per tonne. That represents an increase of more than 40 per cent in a month and more than a doubling compared with some levels seen the previous year.

Spodumene concentrate, another key input in lithium production, has also increased in price and is now trading at around 2,000–2,168 US dollars per tonne. The company says the trend suggests the market is moving away from earlier concerns about oversupply toward a more balanced situation, with the potential for future shortages.

Despite this recovery, lithium markets remain volatile. Several projects worldwide have been delayed as financing costs have risen and investors have taken a more cautious approach to new mining developments.

Decision possible by 2026

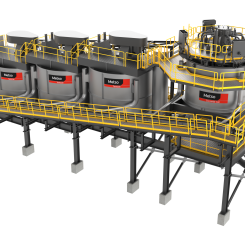

Critical Metals says a formal decision on whether to start mining could be taken before the end of the year, depending on prices and financing. Chair Tony Sage said the company has been in discussions with partner Obeikan in Saudi Arabia, which plans to build a lithium hydroxide facility.

– We have recently met Obeikan, our partners in the hydroxide plant in Saudi Arabia, and agreed on a framework for a ‘decision to start mining’ by the end of 2026 if prices remain robust and financing options are available, he said in a statement cited by the company.

Demand for lithium continues to be driven by battery production, including for electric vehicles and stationary energy storage. Additional uses in robotics and drone technologies are also cited as supporting long-term demand. At the same time, uncertainty around future supply and investment costs continues to affect project timelines.

Strategic role for European supply

The Wolfsberg project is seen as potentially important for Europe’s lithium supply. The European Union has been seeking to reduce reliance on imported battery metals, particularly from China, but several European mining projects have faced local opposition, lengthy permitting processes and uncertain economics.

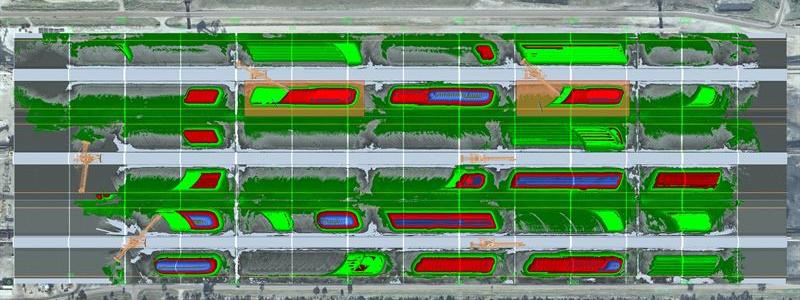

In 2023, European Lithium secured six new mining licences that doubled the project’s area. Extensions were also granted for three existing licences, covering both the Andreas area and the newly defined Barbara field. This means the licence area now extends beyond the current resource zone.

In March 2024, Sizzle Acquisition and European Lithium completed a merger that resulted in the formation of Critical Metals. The company focuses on metals and minerals considered strategic for electrification and advanced industry.

Even with rising raw material prices, the Wolfsberg project still faces multiple uncertainties. European mining developments often involve high costs and complex regulatory processes, and the final decision to proceed will depend heavily on financing, commodity prices and policy conditions over the next two years.

Source: Critical Metals, European Lithium, company information and international mining press.