Energy Fuels announces the acquisition of Base Resources, with the aim to create a global leader in critical minerals production with a focus on uranium, rare earth elements and heavy mineral sands

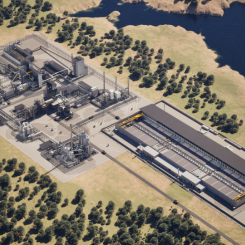

The acquisition includes Toliara heavy mineral sands project in Madagascar, a long-life, high-value and low cost monazite stream, produced as a byproduct of primary titanium and zirconium production.

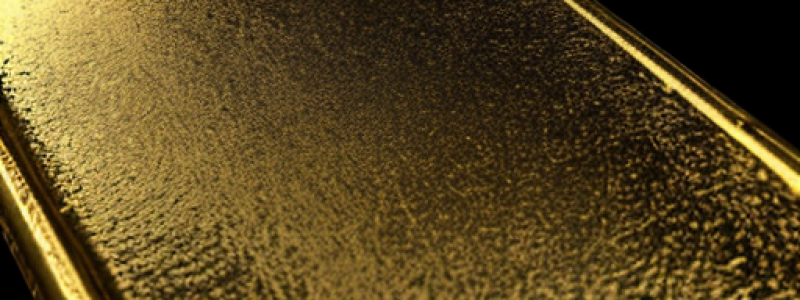

Toliara monazite production to be processed at Energy Fuels' 100%-owned White Mesa Mill into separated rare earth element ("REE") oxides, at low capital and operating cost, setting a new paradigm for low-cost, globally competitive U.S.-centered rare earth oxide production.

The transaction will also secure Base Resources' mine development and operations team, who have a successful track-record of designing, constructing, and profitably operating a world-class heavy mineral sands operation in Africa.

Energy Fuels is currently engaged in high-level discussions with various U.S. government agencies and other offices who provide support for critical mineral projects, domestically and abroad.

Mark S. Chalmers, President and CEO of Energy Fuels stated: "The acquisition of Base Resources and the Toliara project represents a monumental leap forward for the Company, as we continue to execute on a truly revolutionary REE, uranium and critical mineral combined strategy. For the past four-plus years, Energy Fuels has innovated a new way to produce critical minerals, that we believe is more cost competitive than traditional approaches, by leveraging our uranium processing expertise and infrastructure to develop a secure, U.S.-centric REE oxide supply chain.”

"At the same time, we plan to maintain our leadership and profitability in our core U.S.-based uranium business without diminishing our uranium capabilities or uranium growth potential in any way. In fact, Toliara will provide a steady, low-cost source of uranium for the Company over the life of the Project”.

he transaction is complementary to and further strengthens Energy Fuels' U.S.-leading uranium production capability and plans.

Senator Mike Lee, the Senior Senator from Utah and a member of the Senate Committee on Energy and Natural Resources, stated: "I'm grateful to Energy Fuels for their work to ensure the United States has a domestic critical mineral source. The acquisition of Base Resources and the Toliara project will only further their capacity and ability to produce minerals needed for defense, technology, and everyday life."

Conference call on Monday, April 22, 2024 at 8:00 am ET.

LAKEWOOD, Colo., April 21, 2024 /CNW/ - Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) ("Energy Fuels" or the "Company"), a leading U.S. producer of uranium, REEs, and vanadium, is pleased to announce that it has executed a definitive Scheme Implementation Deed (the "SID") with Base Resources Limited (ASX: BSE) (AIM: BSE) ("Base Resources") pursuant to which Energy Fuels has agreed to acquire 100% of the issued shares of Base Resources (the "Transaction") in consideration for (i) 0.0260 Energy Fuels common shares (the "Share Consideration") and (ii) A$0.065 in cash, payable by way of a special dividend by Base Resources to its shareholders (the "Cash Consideration", and together with the Share Consideration, the "Scheme Consideration") for each Base Resources ordinary share held, for a total equity value of approximately A$375 million1. The Transaction will be effected by way of a scheme of arrangement under Australia's Corporations Act (the "Scheme"). Unless otherwise indicated in this news release, all references to dollars or $ are references to United States dollars.

KEY TRANSACTION HIGHLIGHTS

The Transaction will unlock significant value for both Energy Fuels and Base Resources shareholders due to valuable and clearly identifiable synergies.

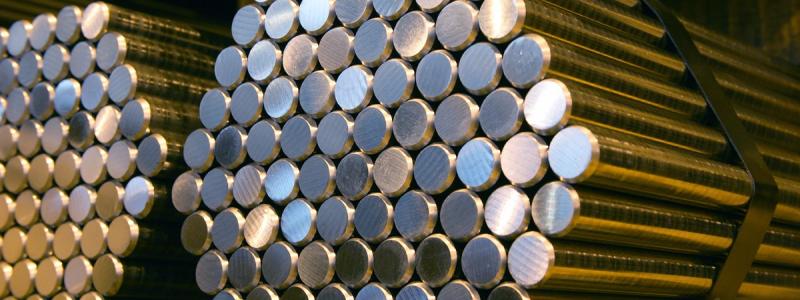

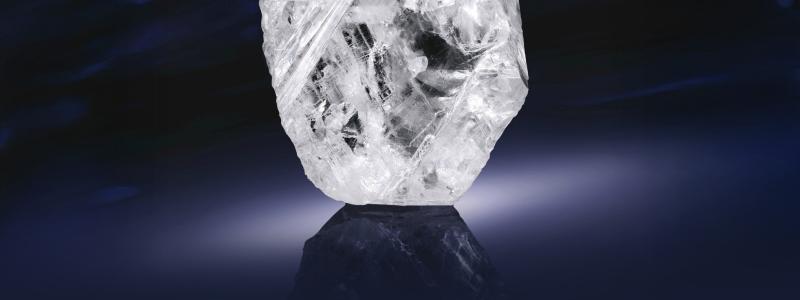

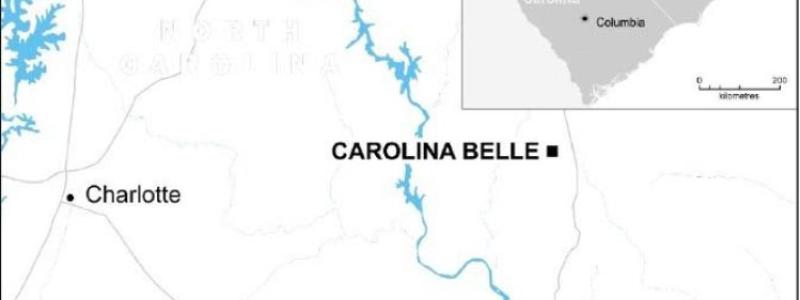

Base Resources' Toliara project in Madagascar is a world-class, advanced-stage, low-cost, and large-scale heavy mineral sands project. In addition to its stand-alone, ilmenite, rutile (titanium) and zircon (zirconium) (collectively, "Ilmenite and Zircon") production capability, the Project also contains large quantities of Monazite which is a rich source of the 'magnet' REEs used in electric vehicles ("EVs") and a variety of clean energy and advanced technologies.

Subject to receipt of further required Government of Madagascar approvals, the Monazite can be recovered as a byproduct of Ilmenite and Zircon production at low incremental cost, thereby adding to Toliara's world-class Ilmenite and Zircon capability at a cost of production that the Company expects to be globally competitive and will position Energy Fuels to be a first-tier REE oxide producer.

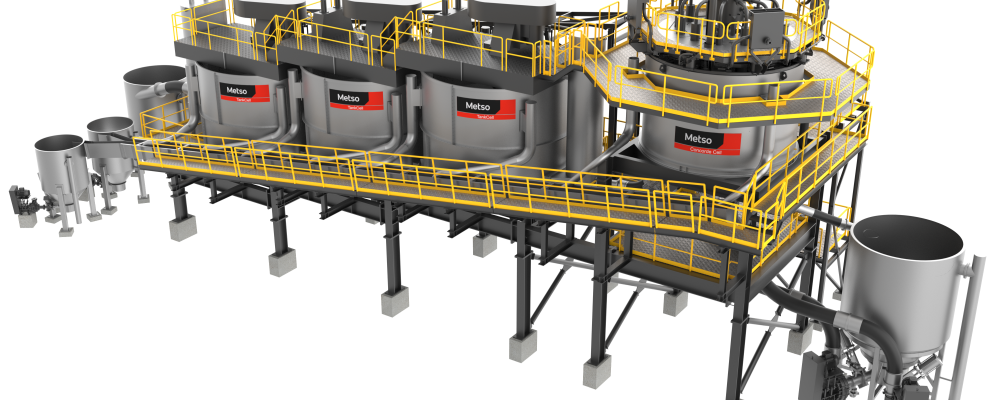

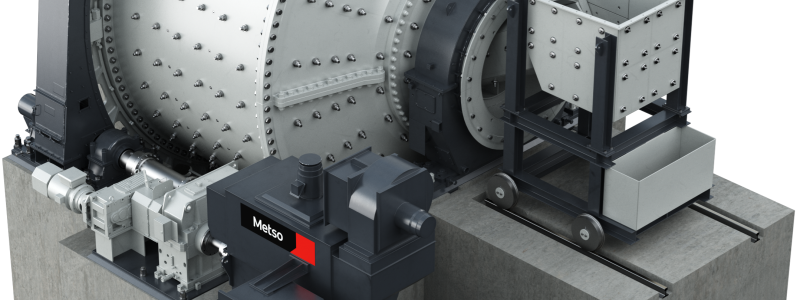

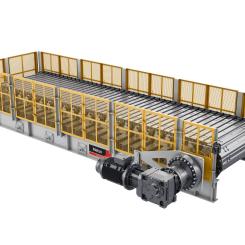

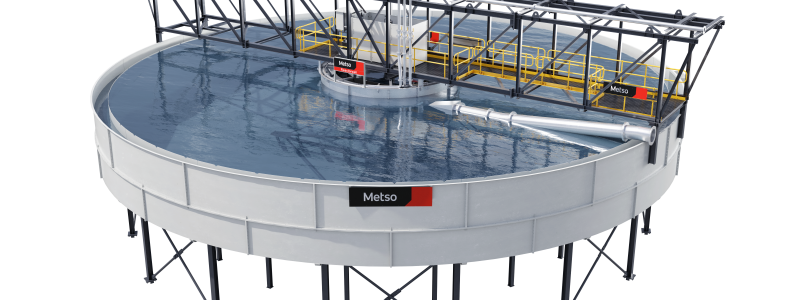

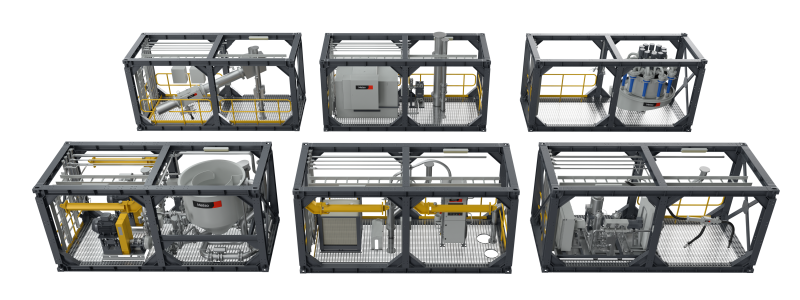

Once in production, the Monazite from Toliara will provide a large portion of the raw materials needed for Energy Fuels' rapidly expanding and world-competitive REE oxide production facility at the Mill. Since 2021, Energy Fuels has proven its technical capabilities, speed-to-market, and competitiveness in a manner that is not being accomplished by any other facility in North America, first by processing Monazite to produce a mixed REE carbonate at the Mill, which it has been selling into the commercial REE market since 2021, and now by the commissioning of its Phase 1 NdPr separation facility at the Mill.

Energy Fuels is currently engaged in high-level discussions with numerous U.S. government agencies and other offices who provide financial support for critical mineral projects within the U.S. and internationally, which may include grants, low-interest debt, non- or limited-recourse debt, loan guarantees, and other support vehicles.

Energy Fuels is also releasing an AACE International ("AACE") Class 4 Pre-Feasibility Study (not a Pre-Feasibility Study subject to or intended to be compliant with National Instrument 43-101 ("NI 43-101") or Subpart 1300 of Regulation S-K ("S-K 1300")) dated April 22, 2024, prepared by Roger Mason, Engineering Manager, WSP USA Environment & Infrastructure Inc., indicating globally competitive capital and operating costs for its planned Phase 2 expanded REE oxide production at the Mill (the "Mill PFS"), which will be filed on the Electronic Document Gathering and Retrieval System ("EDGAR") at www.sec.gov/edgar, and will be available on the System for Electronic Document Analysis and Retrieval Plus ("SEDAR+") at www.sedarplus.ca, and on the Company's website at www.energyfuels.com.

With the Mill's unique, globally competitive, U.S.-based REE production capability, Energy Fuels is uniquely positioned to unlock significant value from Toliara's low-cost Monazite production, in a manner that the Company believes no other facility in the U.S. is capable of at this time.

Monazite from Toliara will also provide material quantities of low-cost uranium production at the Mill over the life of the Project, which will supplement Energy Fuels' U.S.-leading uranium production capacity.

This addition of a low-cost source of REE raw materials to Energy Fuels' globally competitive U.S. REE production infrastructure, along with a sustainable low-cost source of uranium production, is expected to be highly accretive to Energy Fuels' shareholders on a net asset value per share basis, with potential to unlock significant further upside.

As part of this Transaction, Energy Fuels will also access Base Resources' proven leadership and heavy mineral sands operations team, which has an exceptional record of responsible asset development, construction, commissioning and profitable production in Africa. The Base Resources team will not only continue to oversee the development and operation of Toliara but will also enhance Energy Fuels' heavy mineral sands teams in Australia and Brazil, thus allowing the Company to maximize the value of all projects to the Company's shareholders.

The offer is unanimously recommended by Base Resources' Board of Directors and Base Resources has also received voting intention statements from each of Base Resources' two major shareholders, confirming that they each intend to vote in favor of the Scheme2. Those two shareholders respectively hold 26.5% and 24.8% of Base Resources' shares. In addition, each of Base Resources' directors, holding (in aggregate) an additional 1.2% of Base Resources' shares, has confirmed their intention to vote in favor of the Scheme2.

Energy Fuels will host an investor webcast and conference call on April 22, 2024 at 8:00 a.m. Eastern Time (10:00 p.m. Australian Eastern Standard Time).

Mark S. Chalmers, President and CEO of Energy Fuels stated: "The acquisition of Base Resources and the Toliara project represents a monumental leap forward for the Company, as we continue to execute on a truly revolutionary REE, uranium and critical mineral combined strategy. For the past four-plus years, Energy Fuels has innovated a new way to produce critical minerals, that we believe is more cost competitive than traditional approaches, by leveraging our uranium processing expertise and infrastructure to develop a secure, U.S.-centric REE oxide supply chain.”

"At the same time, we plan to maintain our leadership and profitability in our core U.S.-based uranium business without diminishing our uranium capabilities or uranium growth potential in any way. In fact, Toliara will provide a steady, low-cost source of uranium for the Company over the life of the Project”.

"To date, we have secured long-term sources of REE concentrate through offtake (Chemours), and direct ownership (the Company's 100% owned Bahia Project in Brazil once developed, and potentially 100% ownership of Base Resources' Toliara project, and further potential offtakes through a joint venture being negotiated with Astron Corporation Limited (the Astron Donald Project in Australia)). Toliara is expected to be the cornerstone source of feedstock supply to the Mill, with the scale to provide an average of 21,800 tonnes of rare earth-bearing Monazite per year at a cost that we believe will be at or below other leading global REE producers, including those in China.

"Energy Fuels has proven its REE processing capabilities at our Mill in Utah, as we have commercially produced a high-purity mixed REE carbonate since 2021. We recently completed construction of and are currently commissioning the Phase 1 REE separation circuit at the Mill, designed to produce up to 1,000 tonnes of NdPr oxide per year, which would be sufficient to supply enough 'magnet' REE oxides to produce 500,000 to 1 million EVs per year. We have also released the Mill PFS announcing what we believe to be globally competitive capital and REE production costs. Based on these highly compelling economics and the expected consummation of the Base Resources and Astron transactions, Energy Fuels is also planning to update the Phase 2 REE separation infrastructure for the Mill to expand our production capacity to 4,000 to 6,000 tonnes of NdPr oxide per year, along with 150 - 225 tonnes of Dy oxide and 50 - 75 tonnes of Tb oxide per year, which would supply enough 'magnet' REE oxides to power 3 to 6 million EVs per year. This would put Energy Fuels in the REE oxide production capacity category of the other major 'western' REE suppliers.

"We plan to supply REE oxides to U.S., European and Asian EV, wind energy and other clean energy manufacturers, along with emerging commercial REE metal-making, alloying, and magnet-making facilities now under development in the U.S. We also plan to be a reliable supplier to the U.S. defense industry, which could include offtake for other REE oxides, besides the 'magnet' oxides, contained in Monazite. This acquisition, along with the Mill's current and planned REE separation capability, will go a long way in establishing a 'western' REE supply chain. Energy Fuels is also in high-level discussions with numerous U.S. government agencies and offices that support critical mineral projects, and we look forward to advancing these discussions as we continue to build our REE business.

"The transaction will not only secure a world-class project for Energy Fuels at a highly attractive acquisition price compared to the fundamental value of the Project but will also secure a mine development and operations team with a successful track-record of designing, constructing, and profitably operating a world-class heavy mineral sands operation in Africa."

Tim Carstens, Managing Director of Base Resources, commented: "This transaction reflects the exceptional quality of the Toliara project and the efforts of the Base Resources team over several years to advance the project towards construction readiness. The combined company will have the financial and technical capability to not only build Toliara into one of the best critical mineral projects in the world, but also to develop an integrated value chain for the rare earth elements that are essential to the global energy transition. Shareholders of Base Resources will receive both a compelling and immediate premium, and the opportunity to further participate in the market recognition and development of a company with a unique diversified position in the critical minerals landscape."