Barsele Minerals and Gold Line Resources Ltd. announce that they have entered into an arrangement agreement (the “Arrangement Agreement”), dated December 12, 2023, pursuant to which Barsele will acquire all of the issued and outstanding common shares of Gold Line in exchange for common shares of Barsele by way of a plan of arrangement.

The Transaction will create a combined company with a leading gold portfolio underpinned by the advanced stage Barsele gold project currently being advanced by Barsele in partnership with Agnico Eagle Mines Limited.

The Transaction will consolidate a large and prospective gold exploration portfolio in Sweden and Finland; this includes a district-scale property package situated on the prolific Gold Line Mineral Belt in Sweden, totalling over 104,000 hectares, and the Oijärvi gold project (the “Oijärvi Project”) located in the Oijärvi Greenstone Belt of Finland.

Transaction Highlights:

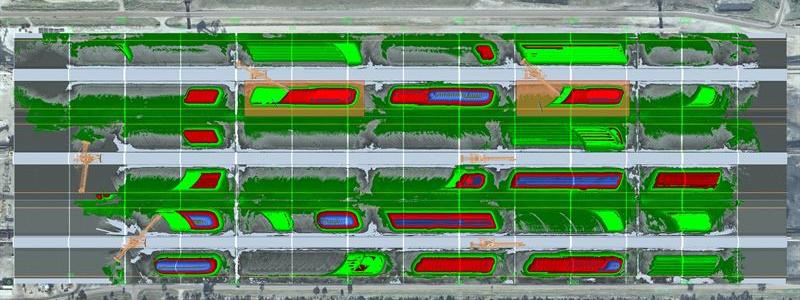

- Consolidating a Prolific Gold District – The Transaction brings together the advanced stage Barsele Project with a district-scale exploration portfolio to consolidate a significant license position in the Gold Line Mineral Belt of Sweden. The Barsele Project lies in the heart of the district with an open pit and underground Indicated Resource of 324 koz gold and an Inferred resource of 2.086 Moz gold (see Appendix, Table 1 for Barsele’s 2019 NI 43-101 Mineral Resource) currently being advanced under a joint venture partnership with Agnico. Gold Line’s flagship projects, Paubäcken and Storjuktan are located to the immediate south and immediate north of the Barsele Project, and the combined total belt position exceeds 100km of regional first-order structural corridor.

- District-Scale Exploration Portfolio in Sweden – Combined exploration portfolio totalling over 104,000 hectares across 41 semi-contiguous exploration permits will be one of the largest license packages in Scandinavia. The commanding land position will cover the majority of the underexplored and highly prospective Paleoproterozoic Gold Line greenstone belt and covers more than 100 km of strike length of the regional Gold Line structural corridor. This belt is host to the development stage +1 Moz Faboliden deposit, and past-producing Svartliden and Blaiken deposits. Exploration work undertaken by Gold Line on the 100%-owned Paubäcken and Storjuktan projects has continued to demonstrate the potential of the belt, yielding positive drill results, including 22.5m of 2.4g/t gold at 45m and 14.6m of 2.5 g/t gold at 142m in recent drill programs completed at Paubäcken where only 600m of a 5km structure has been tested.

- Attractive Portfolio Gold Project in Finland – High grade Oijärvi Project located in the Oijärvi Greenstone Belt of Finland presents a stand-alone belt-scale opportunity for the Resulting Issuer. The Oijärvi Project includes the Kylmäkangas gold-silver underground deposit with an Indicated Resource of 159 koz AuEq grading 4.6 g/t AuEq and an Inferred Resource of 152 koz AuEq grading 2.9 g/t AuEq. (see Appendix, Table 2 for Kylmäkangas 2022 NI 43-101 Mineral Resource). The Oijärvi Project was purchased from Agnico in 2021 and significant opportunity exists for resource expansion and additional regional discoveries.

- Transaction Synergies – Opportunity to deliver cost efficiencies and remove duplicative costs by optimizing resources of the Resulting Issuer and provide for more efficient advancement of the Resulting Issuer’s assets as a single portfolio with a focus on delivering maximum value for shareholders.

- Enhanced Leadership – Resulting Issuer will be led by an enhanced board and management team with a track record of success in exploration, development, mining operations, financing, and capital markets. Taj Singh, currently President and CEO of Gold Line will become President and CEO of the Resulting Issuer and Toby Pierce, currently Chair of Gold Line, will become Chair of the Resulting Issuer.

Gary Cope, President and CEO of Barsele, commented: “This Transaction is a unique opportunity to bring together complementary assets and teams to create a leading gold company with a district-scale focus in Scandinavia. Barsele is delighted to welcome Taj Singh as the new President and CEO and Toby Pierce as Chair following closing. The leadership changes and acquisition of Gold Line’s district-scale exploration portfolio and the Oijärvi Project allows the creation of a larger, stronger and more diversified company with improved access to capital and one of the largest gold exploration portfolios in Scandinavia.”

Taj Singh, President and CEO of Gold Line, commented: “We are very pleased to be combining with Barsele. The Barsele team has done a tremendous job advancing the Barsele Project from an exploration stage project to a joint venture with Agnico. This combination gives Gold Line shareholders a more immediate re-rating and return potential through the advanced stage Barsele Project, while maintaining exposure to the new discovery potential across our district-scale gold exploration portfolio.”