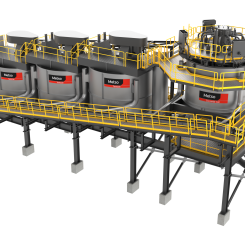

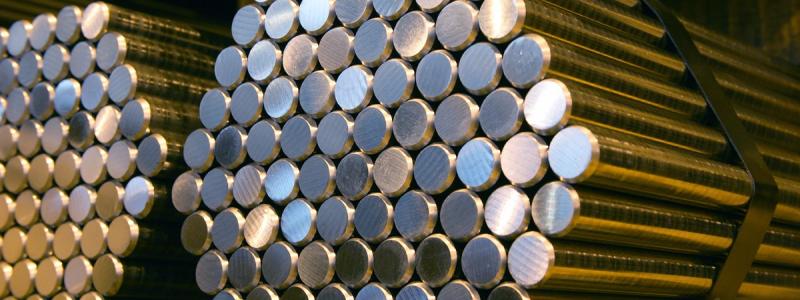

The global metal supply chain plays a crucial role in real estate. Steel, aluminum, and copper are essential building materials, and their availability can influence prices.

For the past few years, the metal supply chain has been rocked by the effects of Covid-19. The pandemic brought businesses and even entire economies to a standstill. Many countries implemented lockdown policies leading to temporary closures of mines and production facilities.

As the world emerged from the worst of Covid-19, commerce faced crippling logistical challenges. Cargo ships carrying critical commodities, like construction metals, could not dock and fulfill shipments. The supply chain was further stretched by sanctions on Russia, the second-largest aluminum producer, following the Ukraine invasion.

All these disruptions have caused an increase in real estate prices across the world. Real estate companies have had to adapt and implement mitigating strategies to offer value to investors and stay competitive.

How Metal Supply Chain Issues Increase Real Estate Prices

Global metal supply chain disruptions increase the overall cost of construction. With developers keen to retain their profit margins, the cost is often transferred to buyers causing the price of real estate to rise.

In extreme cases, supply chain disruptions can cause a total lack of essential commodities leading to extended project timelines. Delays in construction projects further incur additional costs from prolonged labor contracts and holding expenses.

These unforeseen costs can cause developers and investors to incur hefty losses, especially when the extra costs aren't transferable to buyers. Therefore, real estate developers should keep an eye on metal supply chain trends to make informed decisions and lower risks.

Buying a Home During Metal Supply Chain Disruptions

With global metal supply chain disruptions increasing real estate prices, finding your dream property at an affordable price can seem impossible.

Still, you can follow the tips below and get your money’s worth:

Avoid New Homes

While new homes are definitely pleasing, they're constructed with components procured during a supply chain crisis at steep prices. This means the construction materials were bought at steep prices, and should the global metal supply chain return back to normal, your new home can fall in value.

Some developers may also use lower-quality metals to get around supply chain issues and inflated prices. Again, this can cause you to end up with your property being of lower value after future appraisals.

Ideally, you want to hold off on buying a new home until the real estate market conditions are more predictable.

Take Your Time

Buying a home is one of the most significant decisions you can make. It would be best if you took your time to find the right property at the right price. Even after finding your home, don't rush to close the deal. Have the home examined by a professional to make sure everything is of the advertised or stated quality. Also, being patient when negotiating can help you arrive at more preferable terms of sale.

Choose a Realtor Who Specializes in Your Desired Location

When choosing a realtor, find one who has expertise in your desired location. A good example is Neptunus-International, who specialize in Mallorca real estate.

Many good properties are snapped up before they make it into the Multiple Listing Service (MLS), and having an expert in the community can put you on the front foot. It helps to provide your realtor with a prioritized list of features and is an excellent way to start the process. An experienced realtor can also help you understand the real estate market you're investing in.

While metal supply chain issues can affect real estate, the impact can vary significantly depending on the location and length of the disruption