- Few markets have been hit harder in recent years than the one with cobalt, writes American energy analyst Keith Kohl in his chronicle in the journal Energy and Capital.

The short-lived but significant rise in the cobalt price that took place between 2016 and 2018 was followed by an equally incredible price collapse that lowered its value by 70 per cent.

- However, it was not difficult to see why the price suddenly rose like a rocket, states Keith Kohl in his chronicle for the journal Energy & Capital.

Robust forecasts clearly showed that demand for lithium-ion batteries would increase as more electric cars began to appear on the highways. And it didn't take long before more and more countries announced that they would now ban traditional fossil vehicles.

But the good times for investors did not last long, as cobalt prices suddenly dropped from record highs of almost $ 45 per pound. Over the past two years, cobalt prices fell in total to about $ 12 per pound in July 2019.

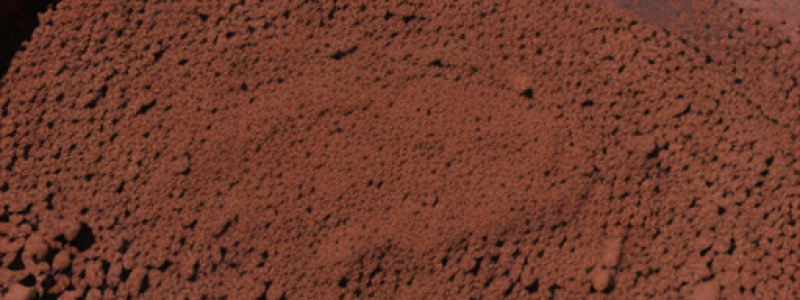

- Perhaps the biggest catalyst was triggered after the Democratic Republic of Congo (DRC) increased supply. More than two-thirds of the world's cobalt comes from DRK. When the rising electric car figures were published, it was for the mining companies to quickly take advantage of the high prices, writes Keith Kohl.

However, according to this US energy analyst, one should expect a possible supply crash, which, however, is not expected to come until 2023.

- If nothing else, there are two bullish catalysts that are still open to cobalt investors. The first is DRC's current difficult financial condition.

When 66 per cent of the world's mining cobalt is mined in a country with enormous potential for geopolitical volatility, according to Koch, one can see how quickly a crisis can emerge.

In August 2019, the world's largest cobalt producer announced that production in the company's Mutanda mine will be reduced due to weak prices.

To put some perspective on this, Koch says it should be borne in mind that Glencore's Mutanda mine accounts for about 20 per cent of the global cobalt supply, but that the mine's hidden reserves are perhaps the largest in the world.

- The second catalyst revolves around the question of how long it will take to implement the global transition to electric vehicles. The longer it takes, the greater the fall in profit for cobalt, says Keith Kohl.

He refers to BloombergNEF's latest forecast of 2019 electric vehicle sales, which calculates that by 2040, 57 per cent of all passenger cars sold will be electrically powered.

- But we fully know the tragic story behind the production from these Congolese mines. Apple has already stated its goal of using only ethical cobalt. What does this mean for investors? The real winners of the cobalt market will be long-term investors who take advantage of current price conditions, recalls Keith Kohl.

- Another potentially bigger winner in the cobalt sector may exist in North America. The US relies heavily on foreign imports to meet its current need for cobalt.

According to Koch, the U.S. Department of the Interior recently released a list of 35 minerals in 2018 that it deemed crucial to U.S. economic and national security.

At the same time, the United States imports about 75 per cent of the country's cobalt, most of which comes directly from China. This has brought the government into action. President Trump announced last June that his administration will accelerate the development of federal projects that focus on these so-called critical minerals.