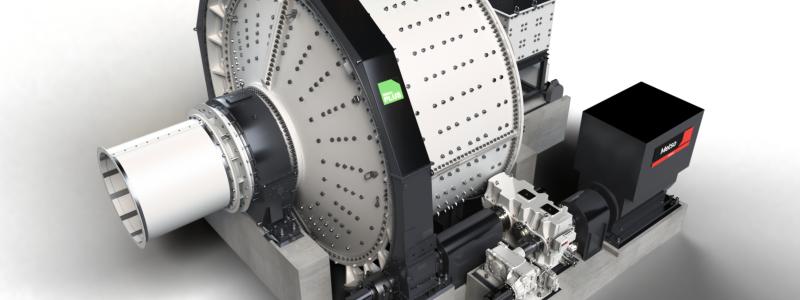

The global transition to clean energy is gaining momentum, heavily relying on renewable technologies such as solar PV cells and wind turbines, as well as energy transition solutions like hydrogen, energy storage, and carbon capture. Simultaneously, the technology sector demands materials with exceptional electrical, optical, and thermal properties, while the defense sector increasingly relies on these critical minerals for high-performance magnets, sensors, and other applications. However, the supply-side risks are jeopardizing international supply chains and could slow the development of key technologies in these three sectors, says GlobalData, a leading intelligence and productivity platform.

GlobalData’s latest Strategic Intelligence report, “Critical Minerals”, identifies four key supply-side risks that sectors reliant on critical minerals face: mineral depletion, resource monopolization, geopolitics, and environmental, social, and governance (ESG).

Martina Raveni, Senior Analyst, Strategic Intelligence team at GlobalData, comments: “Energy transition, technology, and defense sectors have driven an unprecedented surge in demand for critical minerals. The near-term depletion of critical minerals raises concerns, especially amid instability in the mining market, which drives price volatility. Lower-grade ores complicate extraction, making it less efficient, particularly in the copper industry. Recycling will play a key role in diversifying supply chains.”

The concentration of critical minerals in specific regions creates uneven resource distribution and volatile market dynamics. For example, much of the world’s lithium reserves are in South America, the Democratic Republic of the Congo (DRC) provides much of the world’s cobalt, and Indonesia dominates nickel production. To secure supply chains, many nations, including the US and China, are funding infrastructure and energy projects in South America and Africa.

Raveni continues: “In today’s global critical minerals market, ESG considerations play a central role. Among the supply risks are environmental factors such as water scarcity. Indigenous opposition can also affect projects by removing large volumes of mineral production or delaying new capacity.”

Raveni concludes: “Geopolitical tensions are worsening supply constraints on critical minerals. The US and China are engaged in a trade war, which has led to various import and export restrictions. Myanmar's political instability is disrupting China’s supply of rare earth elements. The rise of resource nationalism in South America is disrupting mining projects. Critical minerals are not just raw materials; they are strategic assets.”

About GlobalData

GlobalData operates an intelligence platform that empowers leaders to act decisively in a world of complexity and change.