In an effort to reduce reliance on Chinese suppliers, European automotive manufacturers are making significant investments in mining operations. This strategic shift aims to secure essential minerals required for electric vehicle (EV) production.

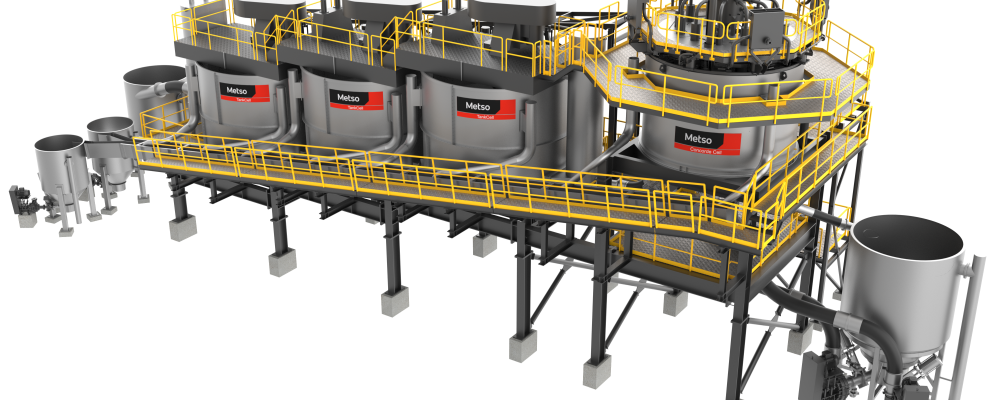

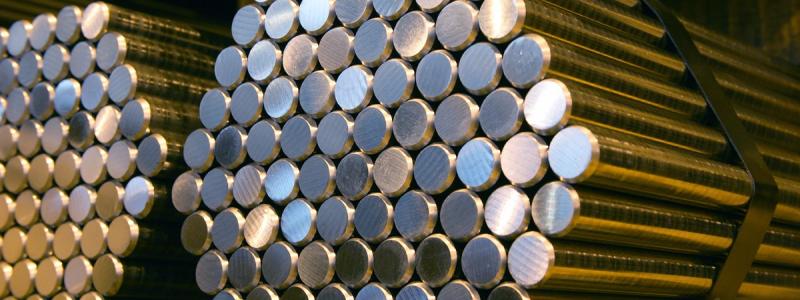

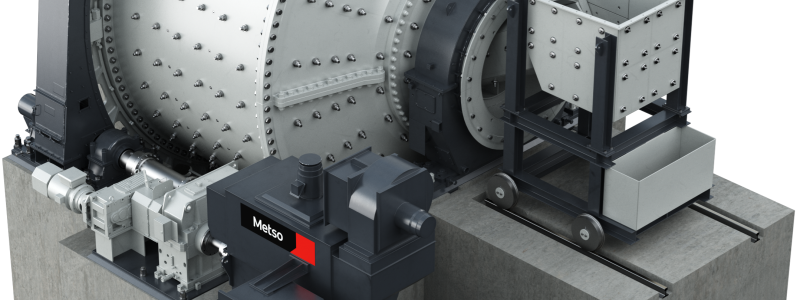

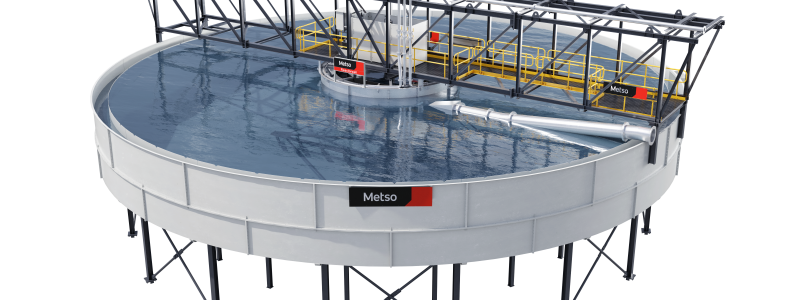

In San Juan, Argentina, near the Chilean border, the Los Azules copper project has garnered attention. Situated at an altitude of 3,500 meters in the Andes Mountains, this site is one of eight major copper projects recently initiated in Argentina. Stellantis, the multinational automotive company, has invested 155 million US dollars to acquire a 14.2 per cent stake in McEwen Copper, the owner of Los Azules. This investment is expected to help Stellantis secure a portion of the projected annual production of 100,000 tonnes of cathode copper starting in 2027 .

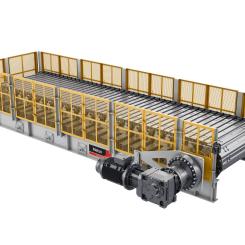

Volkswagen has also taken steps to secure its mineral supply. The company invested 48 million US dollars to acquire a 9.9 per cent stake in Canadian lithium company Patriot Battery Metals. This partnership includes a binding agreement to supply 100,000 tonnes of spodumene concentrate annually for ten years, once production commences .

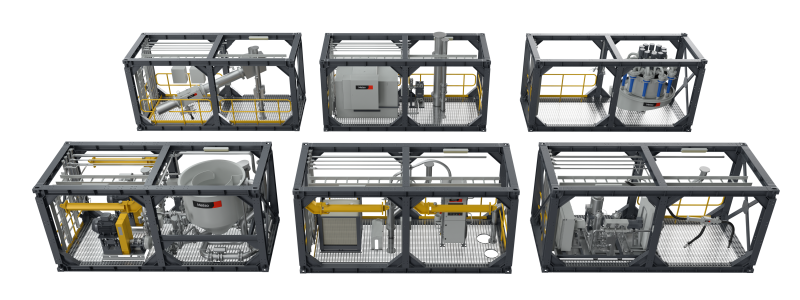

Expansion of Battery Production Facilities

To meet the growing demand for EVs, European carmakers are expanding their battery production capabilities. Stellantis, in collaboration with Mercedes-Benz and TotalEnergies, began constructing its first European gigafactory in France in May 2023. The company plans to build up to five gigafactories in Europe and North America by 2030 .

Volkswagen is also investing heavily in battery cell production. The company plans to establish six gigafactories across Europe by 2030. These facilities aim to meet half of Volkswagen's own battery demand and supply third-party customers .

Despite these efforts, Europe's battery production capacity still lags behind China's. As of 2021, Chinese factories produced batteries with a capacity of 655 gigawatt hours, accounting for three-quarters of global production .

Exploring Alternative Battery Technologies

Contemporary Amperex Technology Co. Limited (CATL), another Chinese company, plans to commence large-scale production of its advanced second-generation sodium-ion batteries in 2025 .

While these developments are promising, experts caution that replacing one internal combustion engine vehicle with one electric vehicle may not be sustainable. Stephane Bourg of the French Geological Survey notes that opening a new mine can take over a decade, making it challenging to meet the projected demand for electric vehicles by 2035. Bourg emphasises the need to rethink transportation models, moving away from individual car ownership to more sustainable alternatives.

Source: Investigate Europe