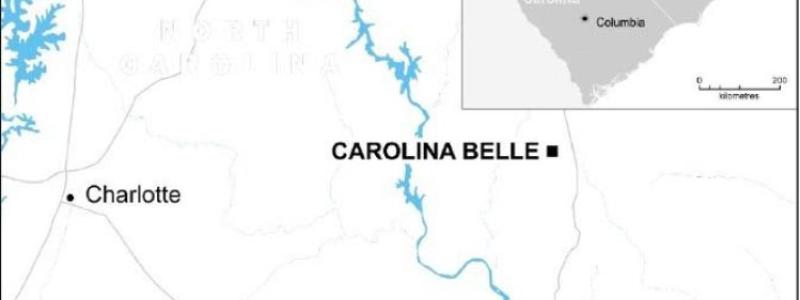

Australia’s Lucapa Diamond plans to divest its 70% stake in the Mothae mine in Lesotho in order to focus on its core assets, and is discussing options for the 30% held by the country’s government.

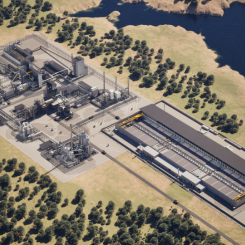

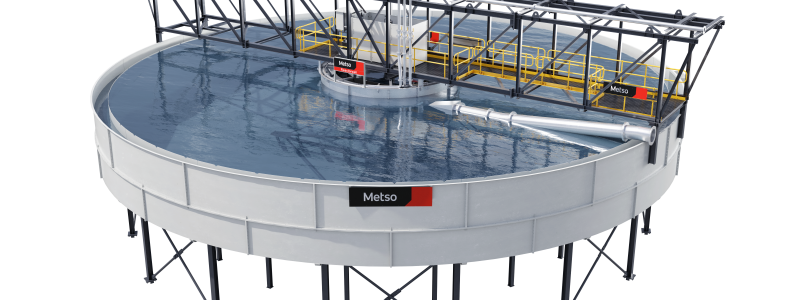

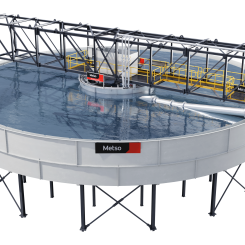

Mothae open pit diamond mine in Lesotho.

Lucapa Diamond announces that its Board “is considering all options for the divestment of its 70 percent stake in Mothae”.

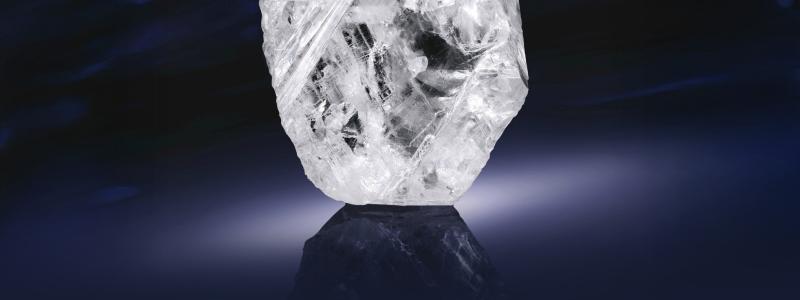

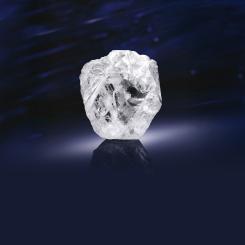

Mothae began commercial operations in 2019 and is known to produce large, high-value diamonds which command the second highest dollar per carat for kimberlite diamonds worldwide.

The Board intends to prioritise the divestment process and will update the market in the coming weeks.

Lucapa Chairman Stuart Brown said, “On review, it is clear the Company should streamline the portfolio to focus on our core assets in Africa and Australia. The Company’s collaboration with the Lesotho Government on the Mothae Diamond Mine has been rewarding and our management have worked exceptionally well to optimise the plant to recover large diamonds. We expect there will be significant interest from those within the diamond industry and on a wider scale.”