Alamos Gold Inc. and Argonaut Gold Inc. announce that they have entered into a definitive agreement whereby Alamos will acquire all of the issued and outstanding shares of Argonaut pursuant to a court approved plan of arrangement.

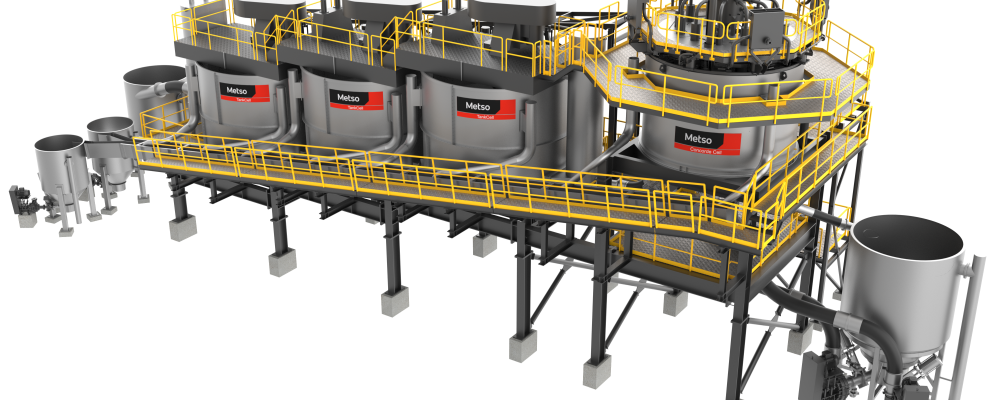

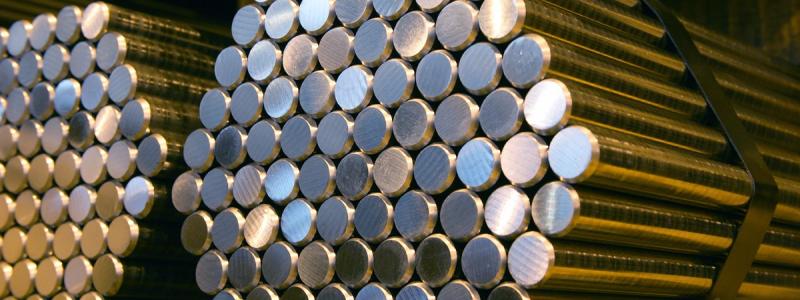

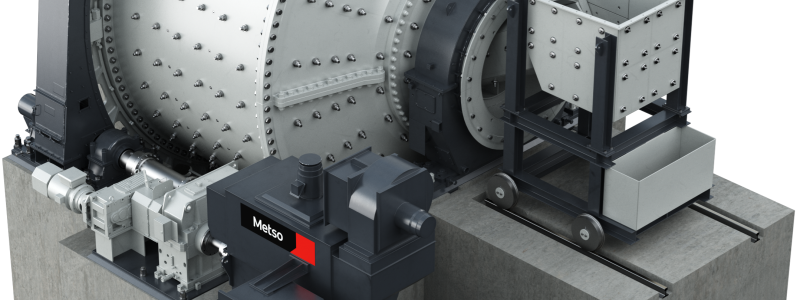

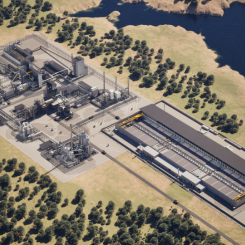

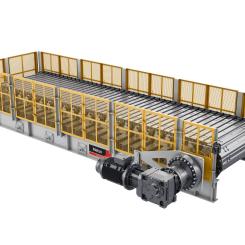

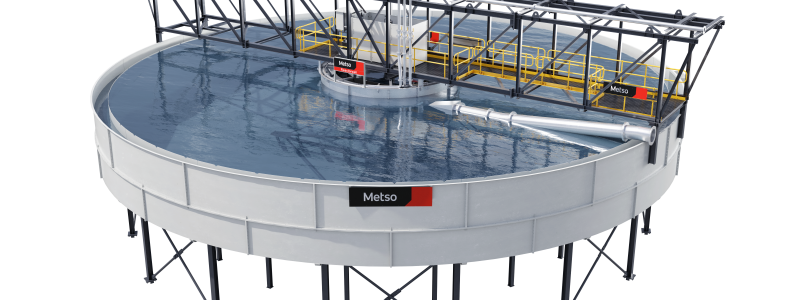

As part of the Transaction, Alamos will acquire Argonaut’s Magino mine, located adjacent to its Island Gold mine in Ontario, Canada. The integration of the two operations is expected to create one of the largest and lowest cost gold mines in Canada. Through the use of shared infrastructure, Alamos expects to unlock significant value with immediate and long-term synergies expected to total approximately US$515 million1. The addition of Magino is expected to increase Alamos’ combined gold production to over 600,000 ounces per year, with longer term production potential of over 900,000 ounces per year. The combination materially enhances Alamos’ position as a leading, Canadian focused, intermediate producer, with growing production and declining costs.

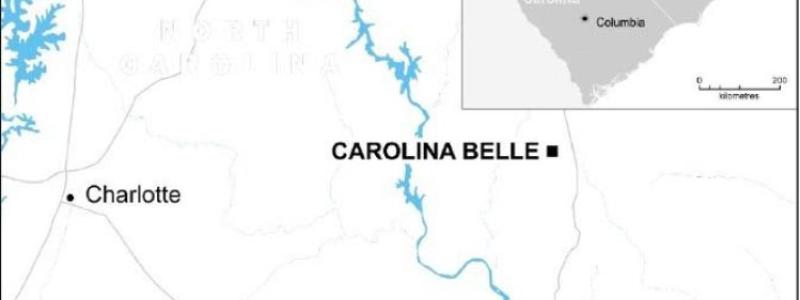

Concurrently with the Transaction, Argonaut’s assets in the United States and Mexico will be spun out to its existing shareholders as a newly created junior gold producer (“SpinCo”). SpinCo will own the Florida Canyon mine in the United States, as well as the El Castillo Complex, the La Colorada operation, and the Cerro del Gallo project, located in Mexico.

Under the terms of the Agreement, each Argonaut common share outstanding will be exchanged for 0.0185 Alamos common shares and 1 share of SpinCo2 (the “Exchange Ratio”). The Exchange Ratio implies estimated total consideration of C$0.40 per Argonaut common share, or US$325 million. This represents a 34% premium based on Argonaut’s and Alamos’ closing prices on March 26, 2024 on the Toronto Stock Exchange (“TSX”), and a 41% premium based on both companies’ 20-day volume-weighted average prices. Total consideration includes C$0.34 of Alamos common shares, based on the closing price of Alamos common shares on the TSX on March 26, 2024, and SpinCo common shares with an estimated value of C$0.063. Alamos expects to issue approximately 20.3 million common shares as part of the Transaction, representing an equity value of approximately US$276 million on a fully diluted in-the-money basis, and an enterprise value of US$516 million.

Upon completion of the Transaction, existing Alamos and Argonaut shareholders will own approximately 95% and 5% of the pro forma company, respectively.