Germany’s industrial conglomerate Thyssenkrupp has reported a significantly larger loss than expected after mounting costs tied to the restructuring of its steel business. In the first quarter of fiscal year 2025/26, the group posted a net loss of 353 million euros, compared with a loss of 51 million euros in the same period a year earlier.

The result was primarily weighed down by restructuring costs in the steel division amounting to 401 million euros, the company said. Analysts surveyed by LSEG had, on average, expected a profit of around 32 million euros, making the outcome far weaker than forecast.

Thyssenkrupp also confirmed its full-year outlook, projecting a net loss of between 800 million and 400 million euros. The figures include provisions for severance payments and other restructuring measures within its Steel Europe unit.

Major job cuts planned

The overhaul of the steel division is expected to have far-reaching consequences for employees. Up to 11,000 of the roughly 26,000 jobs in the steel business could be cut or outsourced in the coming years. The plans form part of a broader effort to reduce costs and adapt production to a more strained European steel market.

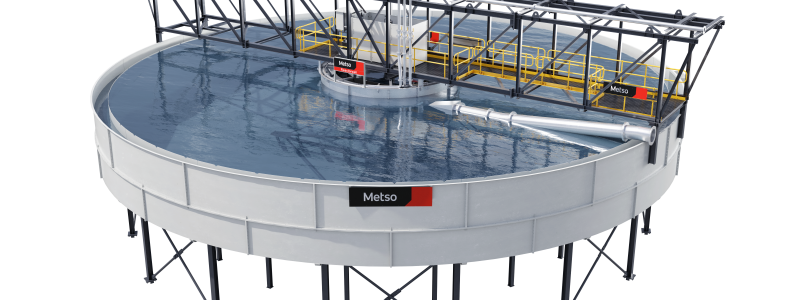

At the same time, Thyssenkrupp is in talks over a potential sale of its steel operations to Indian steelmaker Jindal Steel International. According to the company, the current focus is on a comprehensive due diligence review of the business.

Previous attempts to spin off, list, or form a joint venture for the steel division have failed, prolonging uncertainty over its future. The ongoing review will be decisive for whether a transaction can move forward.

European steel under pressure

Europe’s steel industry continues to face structural challenges, including weak demand, high energy costs and rising import competition. The shift toward lower-emission production methods also requires substantial investment at a time when margins remain under pressure.

For Thyssenkrupp, the costs of restructuring and modernisation are hitting earnings in the short term. Chief executive Miguel López has nevertheless maintained the group’s long-term strategy, describing the overhaul of the steel business as necessary to restore profitability.

It remains unclear when a potential deal with Jindal Steel International could be finalised. Much will depend on the ongoing due diligence process and the broader outlook for the European steel market.

Source: Thyssenkrupp company data, news agency dpa.