The United States is accelerating efforts to reduce its reliance on China for critical minerals. According to Oilprice.com, the Trump administration is preparing new investments that could provide American mining companies with state backing similar to the recently announced MP Materials deal.

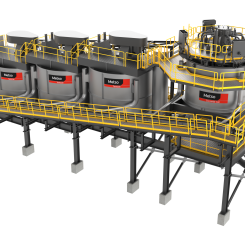

The MP Materials agreement, described as the most aggressive federal push in decades, includes a $400 million investment in preferred shares by the Department of Defence, giving it a 15 per cent equity stake plus options for further shares.

The deal also includes a $150 million loan, while banks such as JP Morgan and Goldman Sachs are coordinating around $1 billion in private financing for the construction of a new “10X facility” in Nevada.

Another key element is a price guarantee: MP Materials will receive a floor price of $110 per kilogram of neodymium-praseodymium magnets, almost double the current market price of about $63. According to Reuters, this ensures stable margins for producers while providing predictable costs for long-term buyers such as defence and electronics firms.

Construction has already started, and the plant is expected to be operational in 2028. MP’s stock has surged more than 300 per cent this year, with other companies in the sector also seeing sharp gains.

Focus shifting to lithium

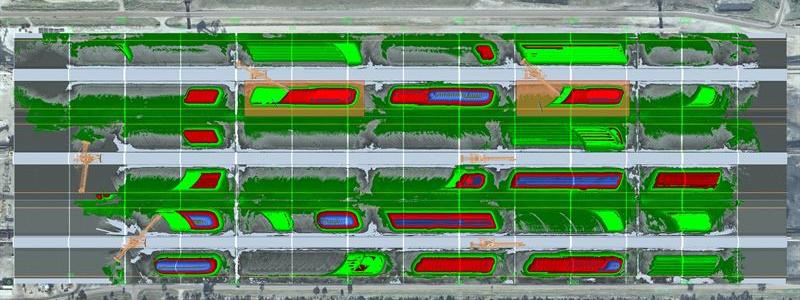

The White House is now considering further support measures, this time for lithium. Canadian-based Lithium Americas is negotiating with the US over a potential state-backed investment in the Thacker Pass mine in Nevada. With operations planned to start in 2027, it could become one of North America’s largest lithium sources. The project includes a $2.2 billion loan and a potential government equity stake.

– The US needs to strike more deals like this if it wants to secure its critical mineral supply and reduce dependence on China, said Mark Chalmers, CEO of Energy Fuels, to CNBC.

An administration official emphasised flexibility.

– We do not rule out further equity stakes or price floors like with MP Materials, but that does not mean every deal has to follow the same model, the official said.

Escalating trade conflict with China

China has long dominated the rare earths market and has used its position as leverage in trade disputes. After Trump raised tariffs on Chinese imports to nearly 65 per cent, Beijing retaliated with a 34 per cent tariff on US goods and new export restrictions on rare earths such as dysprosium, scandium, and terbium.

China had already restricted exports of separation technology in 2023 and earlier limited exports of key metals like antimony, gallium, and germanium, all of which are crucial for semiconductors, defence, and telecom.

US adopts elements of China’s model

The MP Materials deal shows Washington is willing to depart from free-market orthodoxy and adopt a strategy closer to China’s state capitalism, aiming to stabilise supply chains and attract private capital.

– The goal is to move the market so that private industry can follow, said Albemarle CEO Kent Masters to CNBC.

According to National Mining Association CEO Rich Nolan, state investment in minerals such as cobalt, graphite, and lithium could reduce the price volatility that has long plagued US mining firms.

The question now is how far the US is prepared to go in building strategic reserves and domestic supply chains. With China’s countermeasures and surging global demand for minerals in EVs, batteries, and electronics, Washington faces a delicate balance between trade policy and industrial strategy.

Source: Oilprice.com