Appian Capital Advisory Limited and International Finance Corporation, a member of the World Bank Group, have launched a new US$1 billion partnership to accelerate the responsible development of critical minerals, metals and mining related projects in emerging markets.

IFC will anchor the Fund, with an initial contribution of US$100 million, and additional capital will be mobilized by the IFC Asset Management Company. The Fund will invest alongside both existing and future Appian funds, supporting the development of responsible, high-impact mining projects for commodities essential to energy access, critical industries and future-facing technologies.

The Fund is anchored by IFC and aligns with the institution’s investment mandate to finance private sector development in emerging markets while delivering both financial returns and measurable development impact.

It will have a fiduciary duty to AMC introduced investors, ensuring their interests are safeguarded through disciplined oversight, transparency and a commitment to long-term value creation. Managed by Appian, the Fund will co-invest alongside Appian Natural Resources Fund III and Appian Credit Strategies Fund I (together “the funds”), as well as future Appian funds. I

It will target equity, credit and royalty investments in the metals, mining, and adjacent industries across emerging markets, with a focus on Africa and Latin America. All investments made through the Fund will be required to meet IFC’s rigorous performance criteria and environmental, social, and governance (“ESG”) standards.

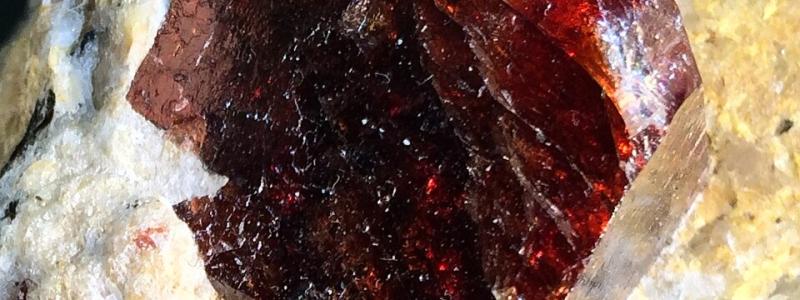

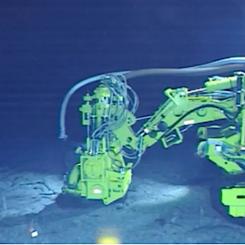

The Fund has agreed to invest in Brazil’s Santa Rita nickel-copper-cobalt mine located in Bahia state, which is currently transitioning to underground production. The mine is expected to ramp up production to approximately 30,000 tonnes per year of nickel equivalent, with a mine life exceeding 30 years.