French automaker Renault is preparing to launch a new generation of electric vehicles equipped with motors that do not rely on rare-earth materials, in an effort to secure its supply chain and lower production costs. According to Reuters, the company is in talks with a Chinese supplier to co-develop copper-based electric motors that are already in pilot production in China.

The move comes just as Beijing temporarily lifts its ban on exports of gallium, germanium, and antimony to the United States while introducing new restrictions on other critical materials. Renault’s initiative is widely viewed as a strategic step to reduce the European car industry’s dependence on Chinese-controlled resources.

A new generation of electric powertrains

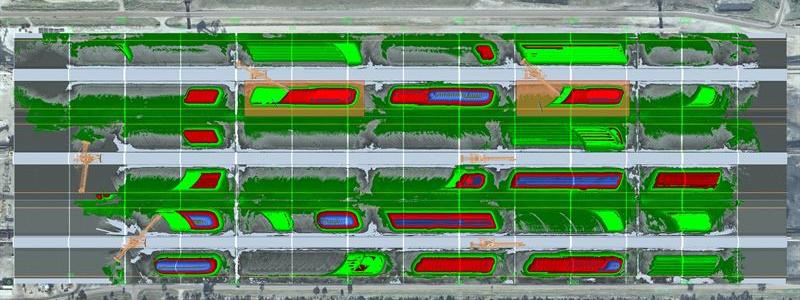

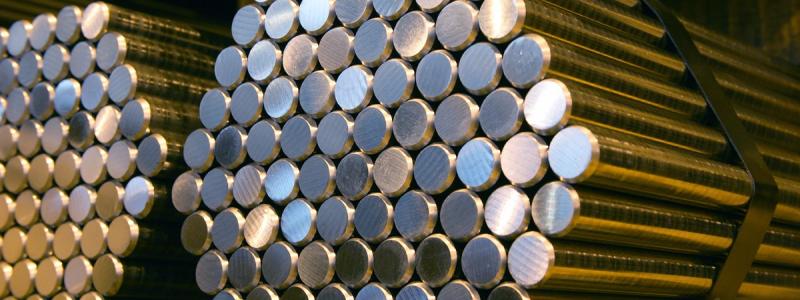

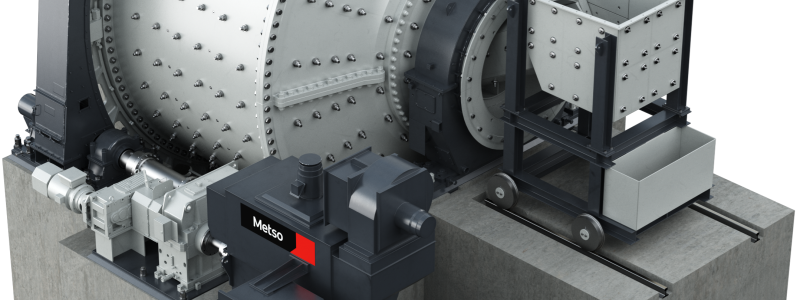

Renault already produces rare-earth-free wound-rotor synchronous motors at its Cléon plant in Normandy, used in the company’s E-Tech hybrid and electric models. These motors replace permanent magnets – which typically require metals such as neodymium or dysprosium – with copper coils, avoiding the use of materials that are environmentally damaging and geopolitically sensitive.

The planned collaboration with a Chinese partner would focus on further refining this motor concept for mass production. According to sources cited by Reuters, Renault aims to lower costs while improving performance for high-volume models scheduled for later this decade.

Both Renault and the unnamed Chinese supplier declined to comment on the discussions, but industry insiders say negotiations have been ongoing since the summer of 2024.

China tightens control over critical minerals

China’s dominance in refining and exporting rare-earth elements has long concerned automakers. The country controls over eighty per cent of global tungsten production and most of the world’s rare-earth magnet output, used in electric vehicles, wind turbines, and consumer electronics.

In late 2024, Beijing introduced new export restrictions on tungsten, antimony, and silver, citing environmental reasons. However, industry analysts view the measures as part of a broader strategic effort to maintain leverage over global supply chains for high-tech materials. The new export rules are expected to take effect in 2026–2027, increasing competition for non-Chinese sources and accelerating the shift toward magnet-free motor designs.

Europe and Japan have tried to rebuild their own refining capacity, but progress remains slow. Even when raw ores are mined outside China, much of the processing still takes place there, leaving automakers dependent on Chinese intermediates.

– Car manufacturers are reassessing their sourcing strategies to reduce exposure to geopolitical risk, one analyst told Reuters. – China’s new export limits could directly impact both the price and availability of motor materials in the years ahead.

European automakers seek mineral independence

Renault is not alone in pursuing alternatives to magnet-based motors. BMW, Volkswagen, and Tesla are also investing in new designs that reduce or eliminate rare-earth use. The aim is not only to cut supply-chain risks but also to address the environmental costs of mining and processing these metals.

Rare-earth extraction often involves large-scale pollution from heavy metals and radioactive waste, particularly in regions with weak environmental regulations. The shift to copper-based motors could therefore bring significant ecological benefits, alongside industrial resilience.

Renault’s wound-rotor design draws on conventional electric motor principles but incorporates advanced control electronics and improved cooling efficiency. The key advantage is that it can be built entirely in Europe without depending on imported rare-earth materials. The design also facilitates easier recycling at end-of-life, in line with the European Union’s upcoming circular-economy regulations for the automotive sector.

Challenges and opportunities ahead

The race toward rare-earth-free motors is taking place as the global electric vehicle market expands rapidly. The International Energy Agency (IEA) estimates that the number of EVs on the world’s roads will rise from 40 million today to over 240 million by 2035. This explosive growth is already putting pressure on global supplies of lithium, cobalt, and rare-earth materials.

For Renault, the proposed partnership with a Chinese manufacturer is a hedge against future shortages and price volatility. It could also strengthen the company’s position in the increasingly competitive European EV market. If successful, the new motor technology could be deployed across Renault’s high-volume production lines in the second half of the decade.

– We are entering a new generation of electric vehicles that are no longer dependent on rare materials and can be produced locally with lower environmental impact, a European industry source told Reuters.

Yet the road to rare-earth independence is far from smooth. Transitioning to a new motor platform requires large investments in manufacturing facilities, staff training, and supply-chain adaptation.

Nevertheless, Renault’s project underscores a broader industrial shift in Europe – one aimed at breaking dependence on critical minerals and reshaping the electric mobility landscape around technologies that are both sustainable and strategically secure.

Source: Reuters, Financial Times, International Energy Agency (IEA)