Liberia’s mining sector is entering a phase of heightened activity as major international investors join smaller risk‑tolerant exploration companies in targeting the country’s gold and iron‑ore resources. Among the latest moves, a new rail agreement between Liberia and Canadian miner Ivanhoe Atlantic may crucially enhance the region’s export infrastructure.

Toronto‑listed Pasofino Gold is seeking CAD 12 million through a private placement to fund a revised feasibility study for its Dugbe gold project in southern Liberia.

Mining surge in Liberia as Ivanhoe and ArcelorMittal move in

The project spans approximately 1,410 km² and was originally explored by Hummingbird Resources, with nearly 90,000 m of drilling carried out. According to a 2021 resource estimate, Dugbe hosts 3.3 million ounces of measured and indicated gold with an average grade of 1.37 g/t plus 0.6 million ounces inferred. For a planned 2026 construction start, the company needs to complete a circa 16,000-metre drilling programme and review infrastructure and power supply.

Meanwhile, other junior explorers are also attracting new funds. Hamak Strategy, in joint venture with First Au, reported drill results in October from the Nimba gold project, including 29 m at 0.97 g/t gold. A week later, the company raised £35 million via a convertible bond and ATM facility. Zodiac Gold announced August results from its Todi project, including 18 m at 4.67 g/t gold, among them 1 m at 55.9 g/t gold. In May, the company raised nearly CAD 1.1 million in a private placement.

Major infrastructure deal could shift regional dynamics

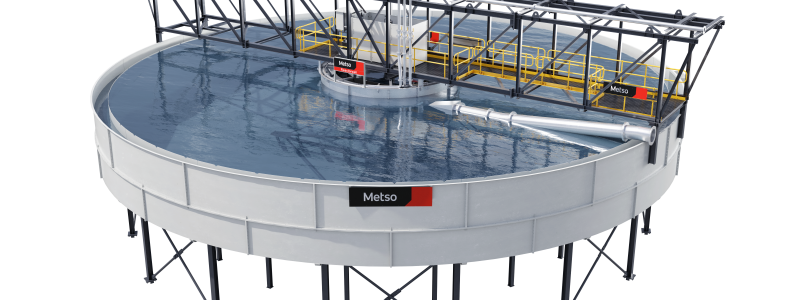

Large‑scale investment is also underway: this summer, Liberia signed a rail agreement with Ivanhoe Atlantic to rehabilitate and operate the country’s 243‑kilometre heavy rail line from the Nimba mountains to the port of Buchanan. The corridor is intended to serve as the first open export rail route for iron ore from both Liberia and neighbouring Guinea. Up to 30 million tonnes of iron ore exports per annum are forecast under the agreement.

The deal represents a break from ArcelorMittal’s prior exclusive rail access under a mineral development agreement. The transition to a multi‑user model is backed by the United States and aims to position Liberia as a regional sea‑transport gateway for West Africa. Under the transitional agreement, ArcelorMittal’s state contract runs until 2030, during which infrastructure upgrades and a fee structure for new users will be implemented.

Risks lie ahead despite investor cheer

While the flurry of activity suggests investor interest in Liberian resources is intensifying, significant risks remain. The timing and cost of infrastructure upgrades, the ability to scale export volumes and commodity‑price volatility all weigh on project feasibility. Exploration juniors must raise further capital, while larger miners face regulatory and logistical hurdles. The broader context of global mining – including increasing scrutiny of environmental and social impacts – also adds uncertainty.

For Liberia, establishing reliable export routes and delivering on infrastructure commitments will be essential. Without those, projects may struggle to achieve intended production volumes or financial returns. The focus on large‑scale mining expansion diverges from smaller‑scale artisanal approaches, raising questions about long‑term community impact and ecological oversight.

Source: Liberian Observer, Company Data, editorial summary