European Lithium (EUR) has sold 3.03 million shares in Critical Metals Corp (CRML) in a private transaction with a US institutional investor, generating approximately 50 million US dollars. The proceeds will be used to develop the Tanbreez rare earth project in southeast Greenland.

The off-market sale was conducted for 16.50 dollars per share. Simultaneously, CRML completed an equivalent private placement of 50 million dollars in equity funding, structured through the issuance of 1.47 million ordinary shares and pre-funded warrants for an additional 1.56 million shares.

All shares and warrants issued in the transaction include resale registration rights.

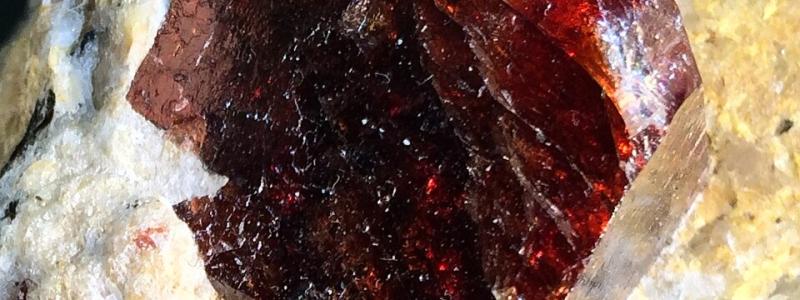

Focus on Greenland’s rare earth reserves

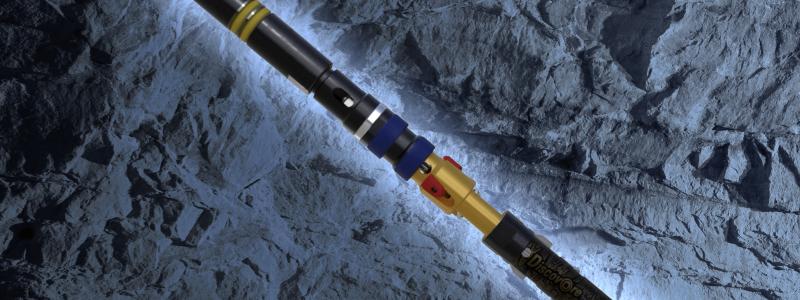

The Tanbreez project targets the extraction of rare earth elements, which are essential for defence, electronics, and battery technologies. Located in Greenland’s south-eastern fjords, Tanbreez has been flagged as one of the few potential sources of rare earths in the Western world, aiming to reduce dependency on Chinese supply chains.

According to the securities purchase agreement, the raised capital will go toward infrastructure, environmental compliance and early-stage development of the Greenland site.

Discrepancy between CRML value and EUR share price

European Lithium’s executive chairman, Tony Sage, said the transaction illustrates “continued investor confidence in the US markets in CRML as they continue to advance the strategic portfolio of critical mineral assets.”

Sage also addressed growing shareholder interest in the perceived gap between European Lithium’s market capitalisation and the value of its CRML holdings. As of 16 October 2025, EUR holds 53,036,338 shares in CRML, and using the Nasdaq closing price of $ 22.72 that day, the stake is valued at approximately $ 1.2 billion US dollars – or $ 1.85 billion Australian dollars.

– That equates to 1.23 Australian dollars per EUR share, which is well above the company’s current market capitalisation, despite recent increases in share price, said Sage.

He added that the company is actively exploring strategic options to “better reflect this intrinsic value” and noted that EUR now holds more than 190 million dollars in cash reserves.

Background: CRML formed through a Nasdaq SPAC merger

CRML was established last year through a merger between European Lithium and the US special-purpose acquisition company (SPAC) Sizzle Acquisition. The merged entity was listed on Nasdaq with a focus on developing and supplying critical minerals for energy transition technologies.

European Lithium’s recent transaction follows broader interest in North Atlantic mineral resources, especially given geopolitical concerns surrounding raw material supply. The Greenland project is viewed as part of an emerging Arctic strategy to secure rare earth production within NATO-aligned regions.