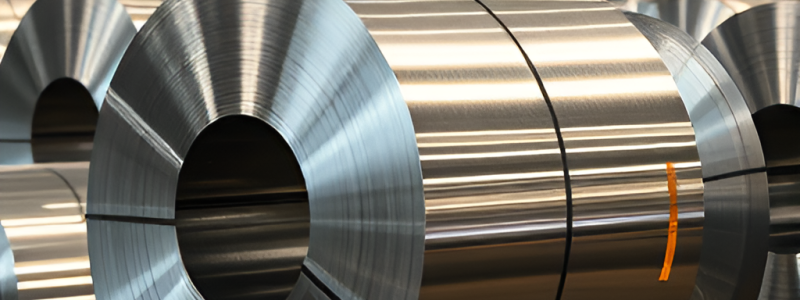

The Finnish stainless‑steel producer Outokumpu has welcomed the European Commission’s proposal to tighten trade protections for the European steel industry, calling it a critical step to protect Europe’s industrial base, maintain economic stability, and preserve capacity for low‑carbon steel production.

The package proposed by the Commission includes:

- Cutting tariff‑free quotas for imported steel by up to fifty per cent.

- Raising customs tariffs on imports exceeding the quota from twenty‑five per cent to fifty per cent.

- Applying a “melted and poured” origin rule—identifying the country where the steel was melted and cast.

- Making safeguard measures permanent but subject to periodic reviews to stay aligned with EU demand.

Outokumpu argues that these actions are necessary to secure fair competition and prevent surges of cheap imports—especially from regions with excess capacity and subsidised production. “These measures are necessary to secure fair competition, protect sustainable European production and prevent import surges that threaten jobs, innovation and decarbonisation,” the company states in its position paper.

Industry under pressure from oversupply and weak demand

The backdrop to these demands is a steel market in Europe marked by weakened demand and rising import pressure. The current safeguard regime—since 2019—has relied on tariff‑rate quotas (TRQs) and additional duties, yet many industry actors—including Outokumpu—consider the measures insufficient.

Outokumpu stresses that a quota system linked to import market shares in weak‑demand years (such as 2012–2013) would better reflect current conditions. The firm also supports strict per‑country caps, and opposes the carry‑over of unused quotas between quarters, which it says undermines market stability.

– “We must regain our competitive edge and ensure the EU’s strategic autonomy in the current geopolitical reality,” says Outokumpu’s Executive Chair.

Sustainability argument and risk of high‑carbon imports

Beyond trade defence, Outokumpu promotes a sustainability argument: Europe’s stainless‑steel industry uses high shares of recycled scrap, resulting in lower carbon emissions compared with producers relying on nickel pig iron (NPI) and coal‑intensive processes. It says its average product footprint in 2024 was 1.6 kg CO₂e per kg of stainless steel (and 0.5 kg for its “Circle Green” grade), compared with a global average of 7 kg.

Allowing higher volumes of high‑carbon, low‑cost imports would, the company warns, erode European melting capacity, increase dependency on foreign supply chains, and raise the region’s overall carbon footprint.

Implementation urgency and industry impact

Outokumpu urges the Commission to implement the new measures ahead of the current safeguards’ expiry in June 2026. The company warns of risk to the EU steel industry if action is delayed, including potential capacity closures and loss of strategic materials supply.

While the proposal has been welcomed by steel industry groups and has already helped boost share prices of European steelmakers, it also raises concerns among downstream users like automakers, which fear cost increases.

Source:

Outokumpu Corporation – “Stronger EU steel trade measures”, October 2025.