Lexington Gold, a gold exploration and development company, with projects in North and South Carolina, USA, announces that it has conditionally raised, in aggregate, approximately £500,000 (before expenses) through a placing, via Peterhouse Capital Limited as agent of the Company, of 10,526,317 new common shares of US$0.003 each in the capital of the Company to certain new and existing shareholders at an issue price of 4.75 pence per Placing Share.

In addition, as the Placing represents a qualifying financing in respect of the convertible loan of £335,000 announced on 26 April 2022 (the "Convertible Loan"), thereby triggering conversion of the Convertible Loan, the Company will issue a further 11,096,875 new Common Shares to the holders of the Convertible Loan notes in respect of the automatic conversion of the principal amount of the Convertible Loan (and accrued interest thereon of £20,100) at the previously fixed price of 3.2 pence per Common Share (the "Loan Settlement Shares")

Highlights:

- · Placing to raise £500,000 through the issue of 10,526,317 common shares

- · Placing price of 4.75p represents a premium of circa. 13.6 per cent. to the Company's 30 day VWAP of 4.18p on 14 October 2022

- · Admission of the Placing Shares to trading on AIM expected on or around 21 October 2022

- · Placing triggers automatic conversion of the Convertible Loan announced on 26 April 2022

Bernard Olivier, CEO of Lexington Gold, said:

"I am pleased to announce this placement at a 13.6% premium to the 30-day VWAP. This show of support and confidence in our strategy from our shareholders is welcome, especially given the current market conditions and the discounted fundraises seen elsewhere in the market. We are looking forward to exciting times ahead for Lexington, including the upcoming release of the maiden JORC Resource for the Company's Jones-Keystone project which is expected in early November 2022. The board is targeting a maiden JORC Resource of up to 100,000 gold ounces at the Jones-Keystone project and we look forward to updating shareholders on our progress."

Edwards Nealon, Chairman of Lexington Gold, said:

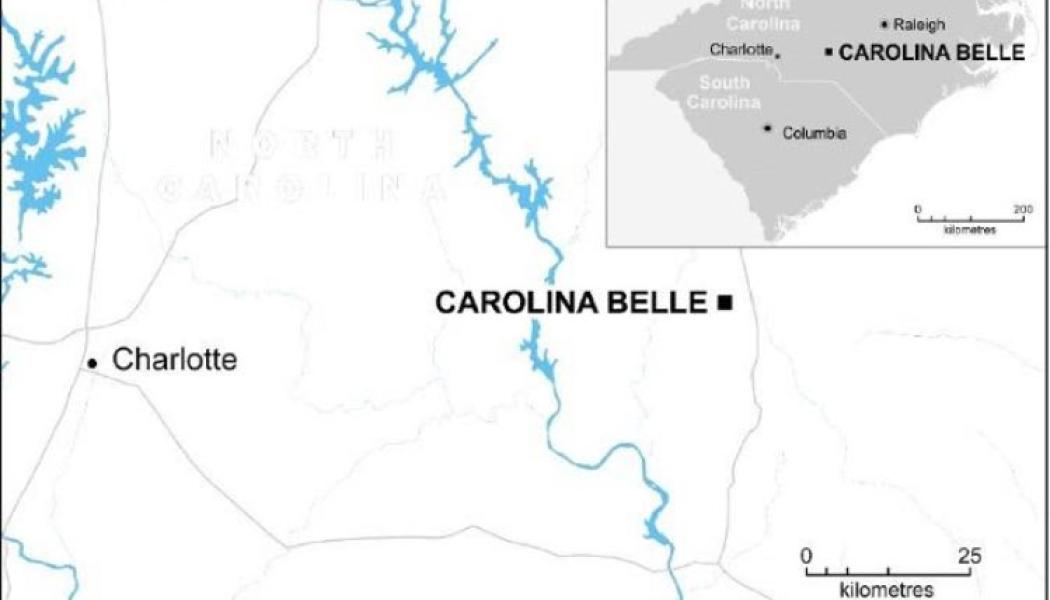

"I would like to thank our shareholders for their ongoing support. Our operational success with drilling, establishing and growing the maiden JORC Resources at our gold projects in the USA has not gone unnoticed. We have recently been approached with additional gold opportunities in the Carolinas and also in other well-known, major gold-producing jurisdictions. We are currently evaluating and considering these exciting potential additional opportunities and we look forward to reporting back after thorough consideration and evaluation should we decide to proceed."

The Placing

Pursuant to the Placing, certain new and existing shareholders have agreed to subscribe for, in aggregate, 10,526,317 new Common Shares at the Placing Price. The Placing Price represents a premium of approximately 13.6 per cent. to the Company's 30-day VWAP of 4.18 pence on 14 October 2022 being the latest practicable date prior to the date of this announcement.

The Placing Shares will be issued conditional upon the Placing agreement between the Company and Peterhouse not being terminated in accordance with its terms and admission of the Placing Shares to trading on AIM, which is expected to take place on or around 21 October 2022. The Placing Shares represent, in aggregate, approximately 3.7 per cent. of the Enlarged Share Capital (as defined below). The Placing Shares will rank pari passu in all respects with the Company's existing Common Shares and will be issued fully paid.

Use of Placing Proceeds

The net proceeds of the Placing will be utilised for:

- · Trenching, surface and soil sampling work at Jennings Pioneer and Argo

- · Potential estimation of a JORC exploration target for Carolina Belle

- · Modelling, planning and design of next Resource Drilling programme at JKL

- · Expediting the JORC Mineral Resource Estimation for the Jones-Keystone side of the JKL Project following the receipt of the 1m assay results

- · Ongoing due diligence, evaluation and negotiations regarding the potential acquisitions of additional gold tenements and gold projects, both in the Carolinas as well as other well-known major gold producing jurisdictions

- · General working capital requirements