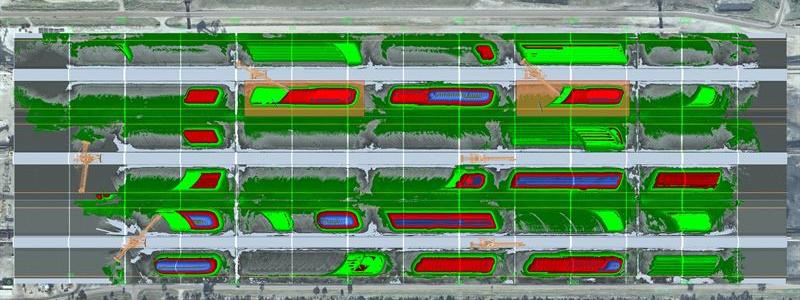

Global copper inventories on the world’s three largest metal exchanges have exceeded 1 million tonnes for the first time in more than two decades. The increase comes as weak demand in China coincides with significant stockpiling in the United States, according to Reuters and market data.

Combined stocks on the US Comex exchange, the London Metal Exchange and the Shanghai Futures Exchange stood at 1,012,065 tonnes at the end of last week. That is the highest level since August 2003 and corresponds to roughly 3.5 per cent of annual global refined copper consumption, which the International Copper Study Group expects to reach 28.7 million tonnes in 2026.

Continued inflows into warehouses in London and Shanghai drive part of the increase. Stocks on the Shanghai Futures Exchange rose 9.5 per cent week on week to 272,475 tonnes, the highest level in 18 months. Demand in China, the world’s largest copper consumer, has remained subdued ahead of the Lunar New Year holiday.

– You’re not actually getting real physical demand. If anything, it’s been restocking out over there, said Robert Montefusco, senior broker at Sucden Financial, speaking to Reuters.

– I think a lot of the physical guys had to step in and purchase or keep stock purely because it looked like the price was running away, he added.

Large inventories in the US

More than half of global copper inventories, 535,715 tonnes, are currently held on Comex, whose warehouses are located in the United States. Over the past year, large volumes of copper have been shipped to the US ahead of a possible introduction of import tariffs from 2027.

However, the build-up in Comex stocks has levelled off in recent weeks. Higher prices on the London Metal Exchange have instead attracted metal into LME warehouses. Copper stocks on the London exchange, which operates storage facilities worldwide, now stand at 203,875 tonnes, the highest level since April.

Recently, the Comex inventories fell by 1,824 tonnes, the first decline since late October. Most of the outflows came from warehouses in Baltimore, according to exchange data.

Used widely across the industry

– There is a lot of stock moving from Baltimore, going from one warehouse to another, Montefusco told Reuters, adding that he does not expect any major drawdown in Comex inventories until there is clarity on potential US tariffs.

Copper is widely used in construction, power grids, electronics and the transport sector and is often seen as a key indicator of global industrial activity. Rising inventory levels may therefore signal weaker short-term demand, even as the market continues to be shaped by trade policy, stockpiling strategies and expectations of future price movements.

Source: Reuters