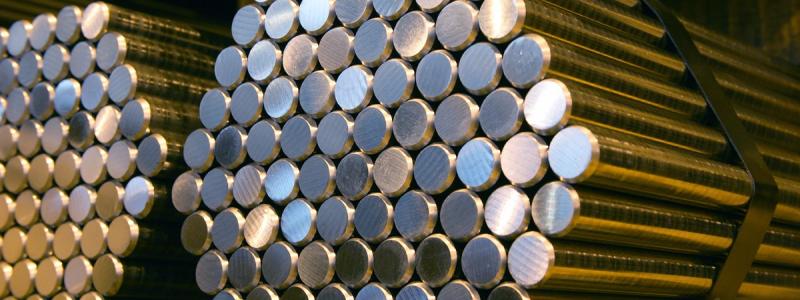

Colombia is emerging as a new player in the global copper market. Over the past year, several international mining companies have intensified exploration, and new geological data suggest that the country may host significant deposits of the critical metal.

One of the most promising projects is the Mocoa deposit in the southern Putumayo region, where resources could reach world-class levels. Long known to geologists, Mocoa has gained renewed attention after new surveys confirmed large quantities of copper and molybdenum.

If developed, it could mark a turning point for Colombia, historically a minor producer of base metals. The country’s mining authorities now believe Colombia could become a stable copper supplier – a metal essential for electrification, power transmission and clean-energy technologies.

Large-scale project in the Andes

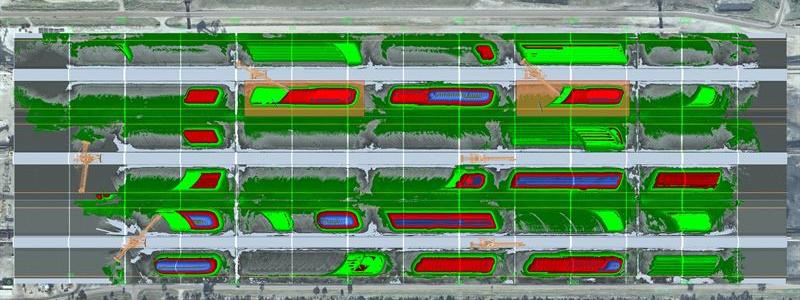

Libero Copper & Gold Corporation, which operates the Mocoa project, describes it as one of the largest undeveloped copper resources in South America. The deposit is estimated to contain more than 600 million tonnes of ore, grading 0.33 per cent copper and 0.03 per cent molybdenum.

Located in the Andes mountain belt – home to major copper mines in Chile and Peru – the area shares similar geological characteristics.

– The findings in Putumayo could show that Colombia has the same geological potential as its neighbours, said geologist Paul Harris in Mining Journal. – If investments continue, the country could become an important copper producer for the region.

Libero has launched a new drilling campaign that will continue through mid-2026. The results could determine whether a large-scale mine will be developed later this decade.

Strategic metals are in short supply

Global copper demand is rising rapidly due to grid expansion, wind and solar power, and electric vehicles. Several major mines in Chile and Peru have reported declining output, raising concerns about a global supply gap.

The International Energy Agency (IEA) estimates that copper demand may increase by up to 50 per cent by 2040 to support the energy transition. That makes projects like Mocoa strategically significant.

Environmental concerns remain, as mining projects in Latin America often face opposition from local communities. In Putumayo, several groups have voiced concerns about water resources and biodiversity.

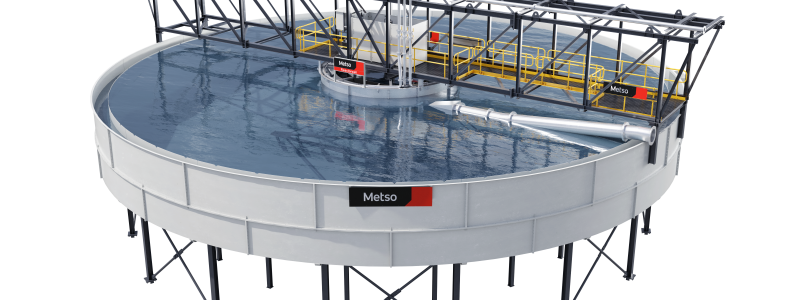

Libero Copper says it aims to make Mocoa a model for responsible mining. – We want Mocoa to demonstrate how modern mining can support local development while protecting natural resources, said CEO Ian Harris.

Colombia’s new mining frontier

Recent discoveries have also drawn interest from other companies. In 2025, Colombia issued several new exploration licenses to firms from Canada, Australia and South America.

The government is seeking to diversify the economy away from coal and oil, promoting copper, nickel and lithium as new growth sectors. Mining Ministerial sources have described “responsible extraction for energy technologies” as a national priority.

If current exploration continues to deliver results, Colombia could, within a decade, transform from a marginal mining country into a significant copper producer – strengthening its role in global resource supply chains.

Source: Mining Journal, Libero Copper & Gold Corporation