Italy is stepping up pressure on the European Union to reform the Emissions Trading System, EU ETS, as high electricity costs weigh on the country’s industrial competitiveness. The issue is emerging as a new fault line in EU energy policy and is expected to remain on the political agenda in the coming months.

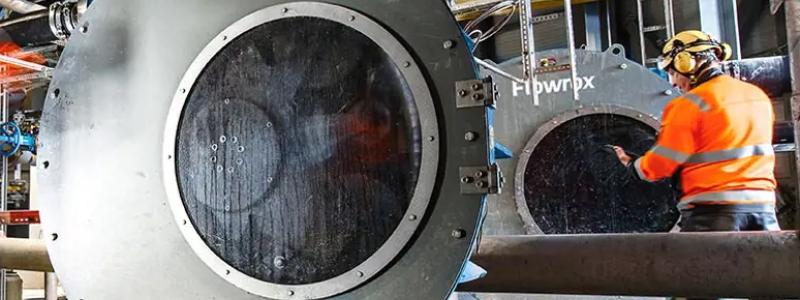

Italy’s steel industry argues that the country’s heavy reliance on natural gas for power generation results in higher indirect ETS costs than in countries with nuclear or coal-based electricity. The gap in energy costs is hitting energy-intensive sectors particularly hard, especially steel producers already struggling with elevated power prices.

Industry calls for change

Antonio Gozzi, chairman of the Italian steel association Federacciai, highlighted Prime Minister Giorgia Meloni’s recent discussions at the EU level on the ETS as a significant development.

– Several countries are paying attention to this approach, Gozzi said, noting that critical issues surrounding the ETS have, for the first time, been prominently featured in political debates in Brussels.

Italy’s power mix relies more heavily on natural gas than many other EU countries. That dependence leads to higher indirect costs tied to emissions allowances and contributes to some of the highest electricity prices in Europe. The government has introduced support measures for energy-intensive sectors, but the industry says price disparities with companies in France and Germany remain substantial.

– It will be essential to follow the dossier with continuity and attention, Gozzi said, stressing the need for sustained engagement from Rome.

EU review ahead

The European Commission has pledged to review the ETS in the third quarter of this year. Several member states are seeking greater price predictability, including extended free allocations or adjustments to allowance caps.

Under current rules, free allowances are set to be phased out completely by 2034 for sectors covered by the EU’s Carbon Border Adjustment Mechanism, CBAM. At the same time, carbon prices have fallen by almost 22 euros per ton of CO2 since mid-January after some member states called for the system to be softened to support industrial competitiveness.

Europe’s steel market is also facing cost pressure. Mills have raised prices despite cautious buyer sentiment. Platts assessed domestic hot-rolled coil in Italy at 650 euros per ton on February 13, up 5 euro day over the day before and 35 euros since the start of the year.

Meloni has described high energy costs as a serious problem for the country’s industry. According to Federacciai, the debate over ETS reform goes beyond climate policy and has become a central issue for industrial competitiveness, particularly for energy-intensive sectors such as steel.

Divided views within the EU

Views on the ETS remain split across the EU. German Chancellor Friedrich Merz recently described the system as effective and growth-promoting, marking a more positive stance than in the past. French President Emmanuel Macron and European Commission President Ursula von der Leyen have also voiced support for the ETS and opposed major changes.

As CBAM gradually reshapes trade dynamics, industry stakeholders are closely watching whether Italy’s push for reform will lead to concrete changes that could reduce electricity price disparities across the EU.

Source: Platts/S&P Global Energy.